Happy New Year! I trust everyone enjoyed a wonderful holiday season. As we eagerly anticipate the Year of the Dragon, I would like to focus on the Chinese economy and its equity markets in this journal entry. But before delving into the prospects of 2024, let's take a brief look back at 2023:

- The robust economic rebound observed in China during Q1, following the reopening, began to decelerate in Q2. This slowdown was attributed to two main factors: firstly, the absence of a substantial consumer stimulus akin to that experienced in the US in 2021/2022 after its reopening, and secondly, the ongoing challenges in the real estate sector that further eroded consumer confidence.

- The incident involving the Chinese balloon had a profound impact on US/China relations, reaching a historic low according to most political experts. This deterioration in relations added to the weakening investor sentiment, despite confirmation from the Pentagon that the Chinese balloon did not gather any information. The incident is reminiscent of the popular 90s show "Seinfeld," characterized as "a show about nothing." While the Xi/Biden meeting in November established a baseline for US/China relations, the extent of improvement in this relationship going forward remains uncertain.

- Facing a stalled post-reopening recovery, the Chinese Communist Party (CCP) opted for a gradual "coffee drips" approach to stimulus, as opposed to the more eagerly anticipated US-style "shock and awe" stimulus. The chart below illustrates the number of policy measures announced throughout the year (note that the chart concludes in Q3, but additional coffee drip announcements continue into Q4).

Source: JPM and Oaktree

- The positive development is that, contrary to numerous media articles predicting an economic collapse, China is poised to conclude 2023 with a GDP growth exceeding 5%, surpassing their target. This outcome underscores the effectiveness of the "coffee drip" approach. However, on the downside, despite the economy displaying stability and improvement towards the year-end, it did not translate into a recovery in the China equity markets, concluding 2023 with another disappointing year of negative returns.

What to anticipate in 2024?

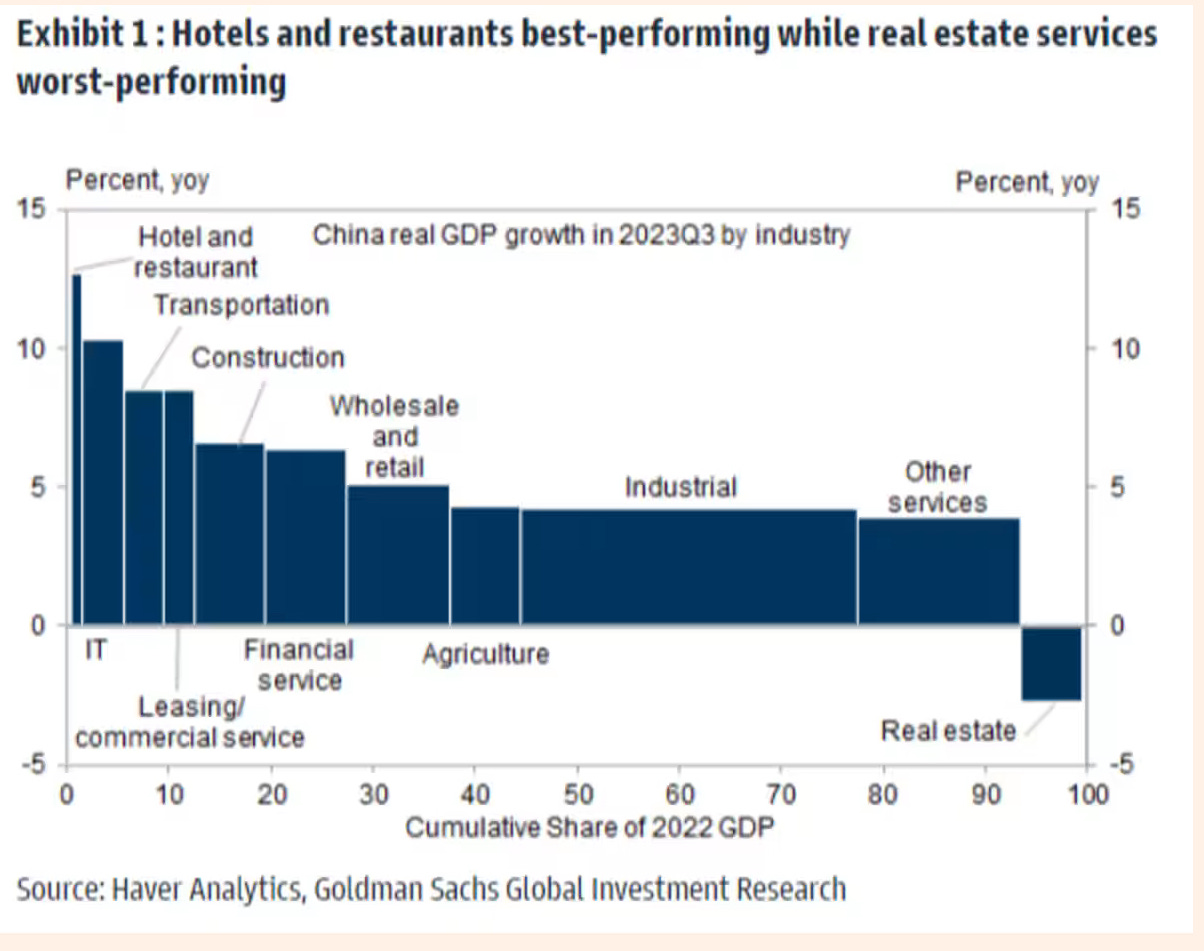

My framework for understanding the Chinese economy this year is predominantly shaped by KKR's analysis of China's GDP in 2022, as illustrated in the chart below:

Source: KKR

In 2022, the real estate sector and its associated industries were the primary economic drag, leading to a 3% growth for the year. Based on the UBS/FT chart below, the negative impact from the real estate sector has diminished from -4% to approximately -1.8%, enabling the economy to achieve growth above 5% in 2023.

Source: FT

Therefore, for 2024, even if the overall real estate sector shows no signs of improvement, as long as the drag on the economy remains constant, achieving a GDP growth of around 5% should still be feasible. In my perspective, the green and digital economy will naturally thrive; thus, the less predictable elements of the economy involve the “other” and “real estate” part of the economy.

Regarding the real estate sector, the government's objectives are evident:

1) After a decade where housing starts (or new supply) consistently outpaced sales, resulting in excess inventory, this trend reversed in 2022. New supply is now decreasing much faster than sales, and this pattern is expected to persist for several years until the excess inventory is depleted (refer to the chart below).

Source: FT

2) The government will continue to support the real estate sector to ensure the construction of pre-sold apartments and to maintain the real estate drag on the economy at an acceptable level, as discussed earlier. However, most of the economic support will continue to be directed towards the "other" part of the economy. Therefore, we can anticipate more "coffee drips" support, given their effectiveness in aiding non-real estate industrial sectors (refer to charts below).

Source: The Daily Shot

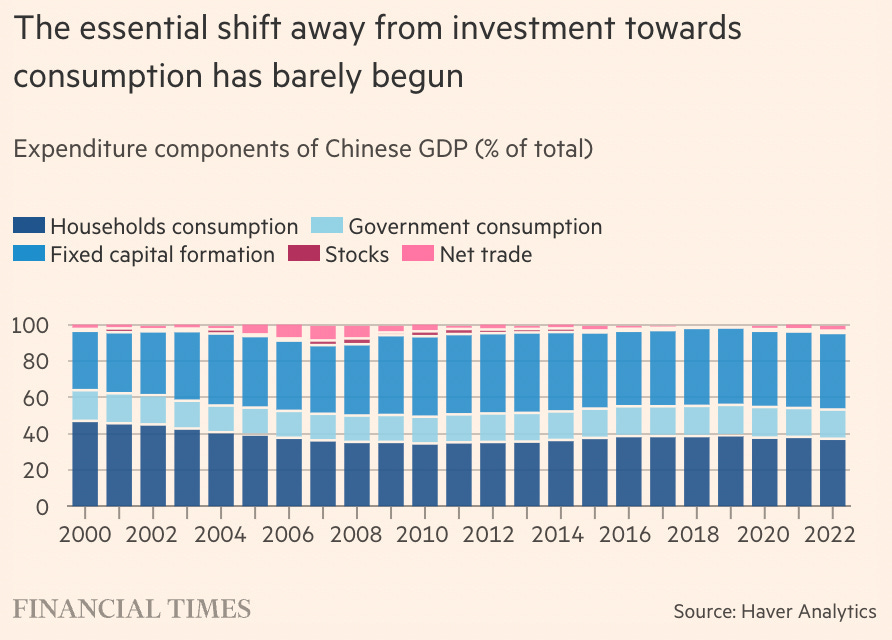

3) Additionally, this year, we are likely (though not guaranteed) to witness policy support aimed directly at boosting consumer confidence. This is crucial for sustained economic growth, considering that consumption as a percentage of GDP remains low, especially in comparison to the US (70%). Longer-term, the economy needs to rebalance towards a composition closer to the year 2000, where household consumption represents a more significant component than fixed capital formation/investment (real estate and infrastructure, etc). Refer to the charts below for details.

Unleashing Household Saving

Boosting consumer sentiment poses a significant challenge, especially considering that real estate often constitutes a substantial portion of people's wealth, and declining real estate prices can impact sentiment negatively. In my opinion, a direct consumption coupon approach would be the most effective policy.

During my time as a student at NYU, there was a Chinese-operated bus company offering round-trip services from NYC Chinatown to Atlantic City for $25. This package included a $25 casino chip coupon with a free buffet. However, to redeem the coupon, one had to exchange $50 of casino chips with their own cash. This coupon tactic worked; the bus consistently attracted a full capacity of passengers. (I visited Atlantic City multiple times during my NYU years and concluded that it was a poor way to make money. The casino tilted the odds in their favor by scheduling the bus to depart at 6 pm daily from Chinatown, with the return trip leaving at 5am from Atlantic City.)

A similar consumption coupon approach could be effective in unlocking the household savings, which currently exceed 100% of China's GDP (see below). However, I recognize that what the government should do and what it will do may differ. Nevertheless, my view is that the government possesses the policy tools to stimulate private consumption.

Risks to 2024 Economic growth

There are two primary risks to economic growth in 2024, from my perspective:

Geopolitical Risk: with two ongoing geopolitical conflicts in the world, one in Ukraine and another in Gaza, there is a constant potential for escalation that could disrupt trade and commerce in the current fragile multi-polar world. Signs of potential escalation include Hezbollah attacks on Israel and the US and UK taking action against the Houthi. Additionally, the parabolic rise in China's auto industry (discussed in Journal #7), now ranking as the #1 exporter globally, has drawn criticism from European politicians. The tactics Europe might employ to counter this rise remain to be seen.

Weak global demand: Despite discussions about reducing supply chain reliance on China, the reality paints a different picture (see below). However, global demand for goods remains weak, which is the primary reason why China experienced its first export decline in seven years, in my opinion. As evident in the global industry growth heatmap chart below, there were numerous red indicators (representing decline) in 2023 compared to the abundance of green indicators (representing growth) in 2021. Unfortunately, I anticipate that the color distribution will not change significantly in 2024.

Equity Outlook 2024 and beyond

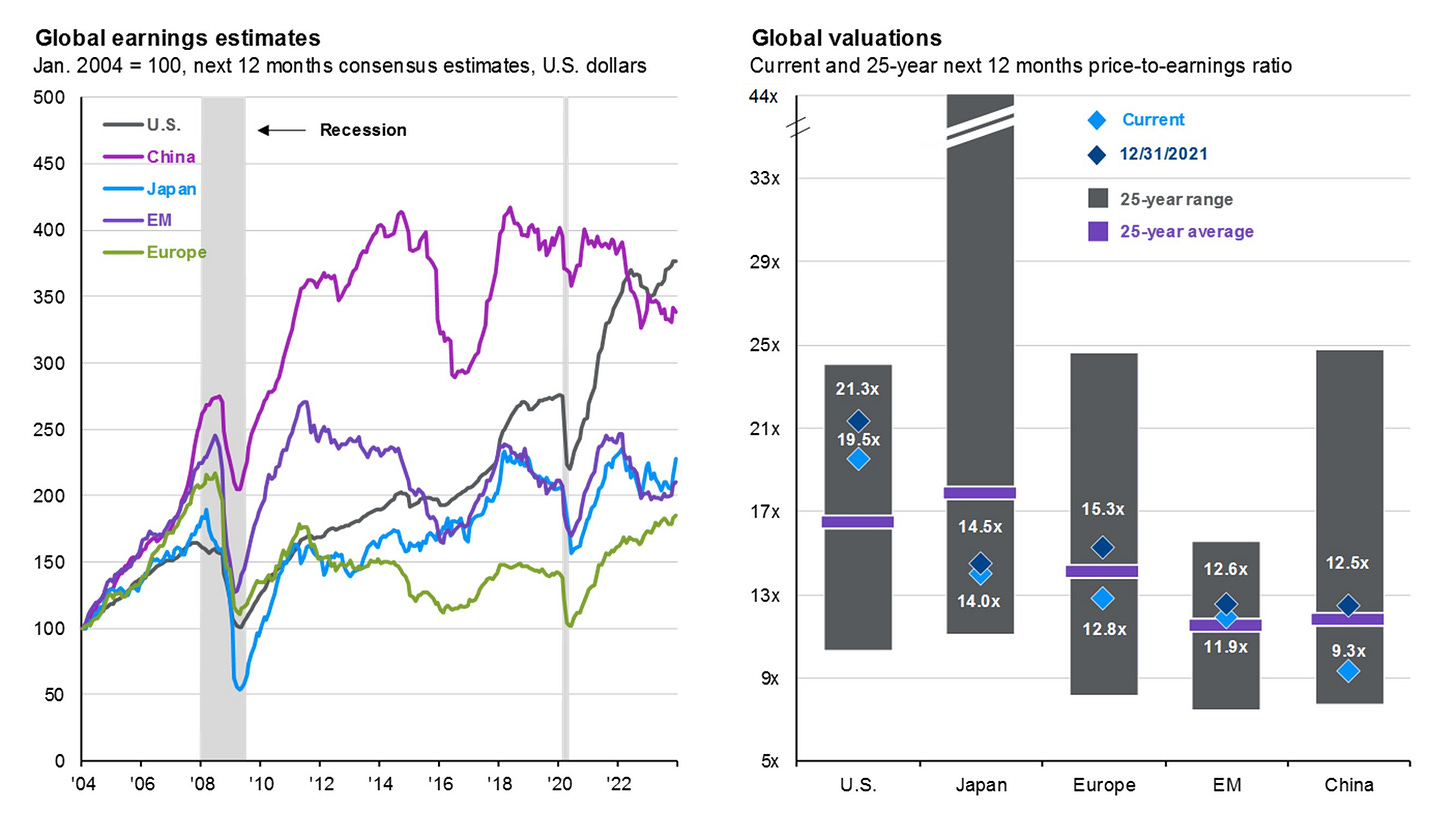

For the China equity markets, here's the good and bad news? On the bright side, the current low valuation (see below chart) and prevailing pessimism suggest that a turnaround from the existing slump wouldn't require a significant catalyst. Echoing the wisdom of legendary investor John Templeton, "Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria." The question arises: How pessimistic are investors about China's prospects? In a recent survey involving 22 global pension funds, managing a total of $4.3 trillion in Assets Under Management (AUMs), “none of the surveyed funds has a positive outlook for China economy or expects higher relative returns from Chinese assets” (source: https://www.omfif.org/wp-content/uploads/2023/11/OMFIF-GPP-2023.pdf). Let me repeat: NONE of the surveyed funds holds a positive outlook.

So, what’s the bad news? The longer the government postpones directly stimulating consumer confidence, the more entrenched this lack of confidence becomes, extending the time needed for recovery. This is why investors strongly favor a "shock and awe" strategy way over a gradual "coffee drips" approach. Additionally, amidst the market's currently extreme low sentiment, any negative geopolitical news between China and the West is likely to be exaggerated, even if it may resemble nothing more than another episode of a Seinfeld-like balloon incident. As always, thank you for reading!