Season's greetings to all! As we immerse ourselves in the holiday spirit and approach the conclusion of the year, it's remarkable to contemplate the swift evolution of Powell's monetary stance. In Journal #6, just two months ago, I delved into the potential risks associated with Powell's unwavering commitment to a "higher for longer" monetary policy. However, the landscape has undergone a dramatic transformation, marked by Powell's decisive pivot at last week’s FOMC meeting, transitioning from "higher for longer" to a new paradigm of "rate cuts in 2024." Now, in Journal #8, my focus is on examining the implications of the Fed's recent pivot.

Commencing with the initial rate hike from zero in March 2022, the Fed Funds rate surged to over 5% in a mere 18 months (refer to the graph below). Looking ahead, as the Fed committee anticipates three rate cuts in 2024 (in contrast to the market's expectation of six cuts), the pivotal question looms large: will these cuts materialize with or without an accompanying recession? In other words, are we headed for a soft landing or a more ominous hard landing?

The Elusive Soft Landing

History has not favored the optimists seeking a soft landing; since World War II, the US economy has weathered 13 recessions. How many soft landings has it experienced during the same period? Just one, if we exclusively consider a durable soft landing. This unique occurrence transpired after the 1993-1995 rate hikes without recession, leading to five years of sustained economic expansion until the 2001-2002 recession. It's this rare success that earned then-Fed Chairman Alan Greenspan the nickname "Maestro."

Expanding the definition to encompass the "softish" landings, as articulated by former Fed Vice Chair Alan Bender in the chart below, introduces four more instances of potential softish landings since World War II (note: the classification of these softish landings is subject to debate. For instance, Bender asserted that the rate hike cycle of 1999-2000 concluded with a "softish landing." True, between the last rate hike in July 2000 and March 2001, the economy seemed robust. However, considering that the recession commenced in April 2001, the characterization of this period as a softish landing becomes questionable.)

Source: https://www.brookings.edu/articles/what-is-a-soft landing/

Hence, from a statistical standpoint, even when generously including the four "softish" landing episodes, the historical odds of a soft landing stand at 28% (5 / (5+13)). Imagine asking any professional gambler if they would engage in a casino table game with only a 28% chance of success; undoubtedly, the gambler would walk away. However, on Wall Street, the prevalence of soft landing narratives tends to surge whenever the Fed pivots, as noted by Michael Kantro, Chief Strategist at Piper Sandler (refer to X note below).

https://x.com/MichaelKantro/status/1733145538348916875?s=20

So why do so many intelligent individuals place their bets on something with such low odds? This is where another piece of Buffett's wisdom becomes relevant: "Don't ask the barber whether you need a haircut." A significant portion of Wall Street thrives on transaction fees rather than investment performance. Recession inevitably curtails transactional activities, making the allure of soft landings, however improbable, a tempting narrative.

The Challenge of Taming the Unemployment Beast

Why is it such a formidable task to engineer a soft landing? Nobel Prize-winning economist Milton Friedman delved into this question through extensive research on the long historical spans of monetary policy and economic cycles in both the US and the UK. His conclusion was straightforward: "there is much evidence that monetary changes have their effect only after a considerable lag and over a long period, and that the lag is rather variable." According to Friedman, this lag could range from 6 to 29 months in the context of monetary tightening.

Friedman illustrated this lag by likening it to taking a shower with old pipes in the midst of a cold winter. Initially, despite turning on the hot water, the water in the pipes might remain freezing cold. The shower-taker may respond by turning up the hot water even further. It's only after a substantial delay that the water eventually becomes hot, perhaps even too hot, prompting the shower-taker to readjust the water temperature.

However, unlike the brief discomfort experienced by the shower-taker, if monetary conditions become excessively tight for an extended period, it can unleash the beast of unemployment. Once unleashed, this beast may not easily be contained and could take on a life of its own. The accompanying chart illustrates the US unemployment rate (in blue) alongside its 24-month moving average (in green), with periods of US recessions shaded in grey. Historically, once the unemployment rate exceeded its 24-month average, the acceleration momentum continued for at least another 1.5% to 2%, resulting in a recession. Notably, during the only durable soft landing in 1995, the unemployment rate never surpassed its 24-month average.

So, where do we stand now? The current unemployment rate is essentially at its 24-month average.

Source: Tradingview

What Lies Ahead After the Pivot?

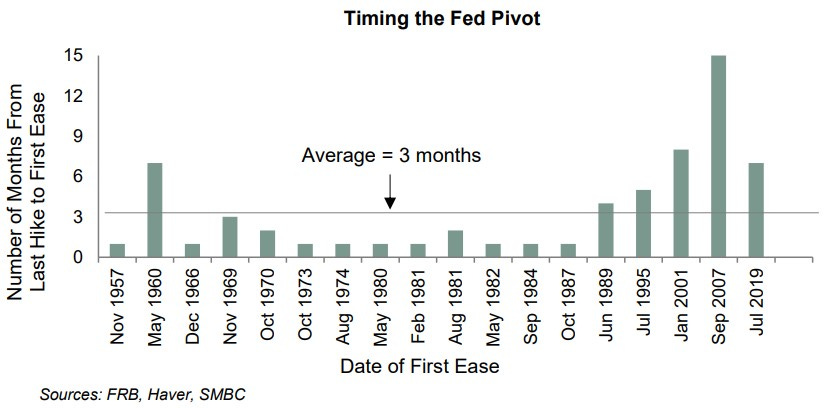

For fixed-income investors, smooth sailing appears to be on the horizon. Given that the last actual rate hike occurred in July of this year, we have already surpassed the historical average time between the last hike and the first easing (refer to the data below). From my perspective, if the unemployment rate climbs from its current 3.7% to 4%, significantly surpassing its 24-month average, the Fed is likely to implement cuts. Consequently, the monthly job data released on the first Friday of each month will carry increased significance in the coming year.

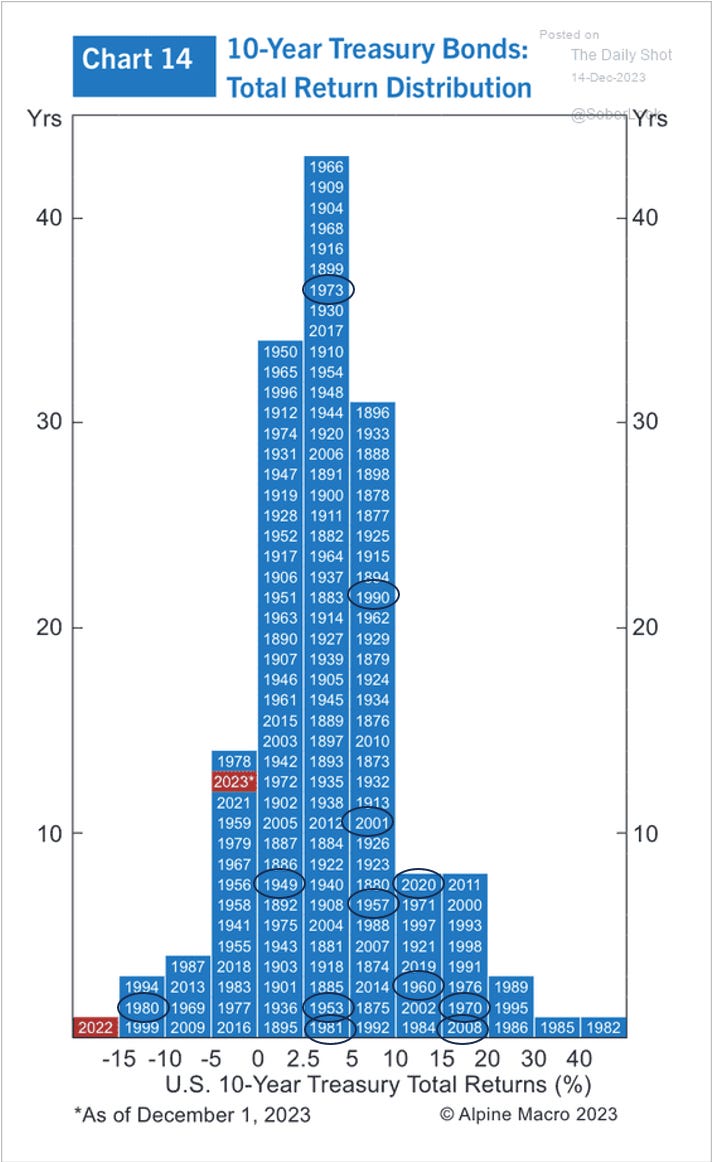

Moreover, for bond investors, irrespective of whether the economy heads into a recession or not, the worst seems to be behind us. As illustrated in the chart below, 2022 marked the worst return in history for treasury bonds; 2023 is expected to conclude with flat returns, with December likely contributing to a gain. Notably, historical trends suggest that recession years, circled in the chart for the post-World War II periods, were favorable to bond investors. The soft landing year in 1995 also demonstrated a positive outcome for bond investments.

For equity investors, the distinction between a soft and hard landing holds significant implications. A durable soft landing heralds a new bull cycle for equity investors, akin to the prosperous period from 1996 to 2000 following the 1995 soft landing. Conversely, a hard landing would prompt a reset in equity prices, as illustrated in the S&P 500 ETF chart below. The extent of this equity price adjustment depends on factors such as the duration and severity of the recession, as well as the response from the Federal Reserve. However, a minimum correction of 15%-20% should be anticipated, and based on historical patterns, a 40%+ correction would not be unprecedented.

Source: Tradingview

Returning to the question posed in the title: Should we celebrate the Fed pivot? The answer for fixed-income investors is a resounding yes. Uncork a bottle of Krug and savor the holidays. As for equity investors, why not? Celebrate a little during the holidays; however, while you indulge in your Krug, bear in mind that the Fed pivot simply means Powell the pilot has announced we are approaching the final hour before arrival, but the plane hasn't landed yet. So, fasten your seat belt, ensure the seatback and tray table are in the upright position, and prepare for landing. Wishing you happy holidays! Thank you for reading!