Greetings. In light of Xi's visit to California this week, I would like to focus on the Chinese economy in Journal #7.

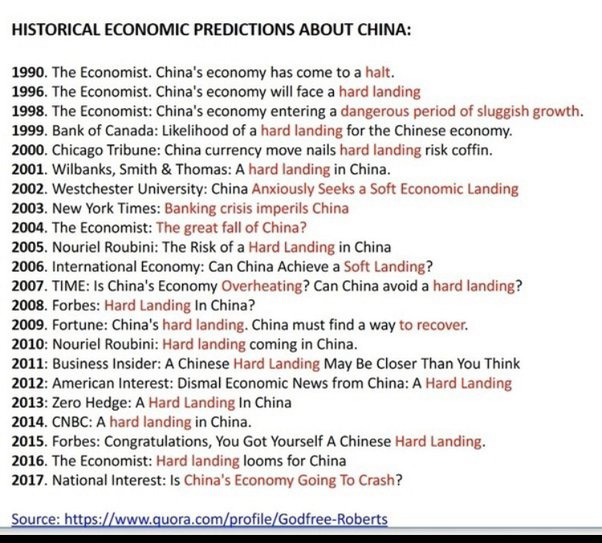

According to a widespread legend, Mark Twain read his own obituary in one major American newspaper in 1897; he then wrote back to the newspaper, "the reports of my death are greatly exaggerated." This is how I feel about Western media reporting on China's economy this year. Among the worst offenders, in my view, is The Economist. Below are three Economist cover stories between May and August this year:

Then, last month, the sister company to The Economist, The EIU, whose sole purpose is to "address the issues that readers of The Economist were asking," wrote that "China’s economy is stabilizing," and that "we retain our forecast of 5.2% real GDP growth for 2023," which is even higher than the GDP growth target of 5.0% from the CCP. (Source: https://www.eiu.com/n/chinas-economy-is-stabilising/#:~:text=In%20line%20with%20EIU's%20projections,the%20economy%20has%20bottomed%20out.)

This is somewhat amusing, to say the least, but not entirely surprising. According to The Economist and other media outlets, China has been depicted as failing consistently over the past 30 years (see below). My conclusion is that the headline of a hard landing in China sells newspapers and magazines.

China Next 10 Years

Forget about the past; let's shift our focus to the future. I believe that China, in the next 10 years, will experience growth at a sub-5% level, and it is completely fine. This isn't an economic forecast, as I am not an economist, but my perspective is grounded in a simple financial concept called the law of large numbers. This principle states that as a company or country grows, it becomes increasingly challenging to sustain its previous growth rates. I appreciate simple concepts.

The U.S. economy was $11 trillion in 2003, growing at an average rate of 2.1% per year over the next 20 years to reach a $25 trillion economy today. Let's generously exclude the negative growth or recession years; the average growth in the past 20 years for the U.S. becomes 2.6%. In contrast, China enjoyed an average growth of 8.4% per year over the past two decades, transforming from a $2 trillion economy to an $18 trillion economy today. Refer to the table below for a detailed comparison:

If the mighty USA could only achieve a growth rate of 2.6% (using the generous number) from an $11 trillion economy, why should anyone be surprised that the Chinese economy, currently at $18 trillion, may only grow at a low single-digit level going forward?

Let's consider a hypothetical scenario where China, in the next 10 years, grows at just 3.5% on average (clarifying that this is not a forecast but an illustration), and India, often regarded as the "Next China," grows at 7% (double that of China and more than its past 20 years' growth of 6.2%). Even with this modest single-digit growth rate, China's incremental GDP over the next decade would still surpass the ENTIRE GDP of “Next China” in 2033 (see below). This underscores why a low single-digit growth rate for China is not only fine but perhaps more than sufficient.

Note: Not a forecast but an illustration

Issues more important than the GDP Growth

As an investor in China, I believe what holds more significance than the GDP growth number are: 1) the expansion of China's middle class and 2) the transformation of the Chinese economy.

China’s Growing Middle Class

Irrespective of cultures and political systems, middle classes globally aspire to similar things: improved homes, better food, enhanced healthcare, and luxury travel experiences as their incomes rise. The United States achieved a 5% average increase in GDP per capita over the past 50 years, establishing the world's largest service and consumption market. For China's economic success to persist, it must continue expanding its middle class and transforming to a service and consumption-oriented economy.

Encouragingly, a recent study by the Boston Consulting Group anticipates an 80 million increase in China’s “middle class and affluent consumer (MAC)” segment, reaching nearly 40% of the total population or 554 million MACs by 2030. Additionally, the study projects that 70% of these new MACs will reside in 3rd and 4th tier cities, enabling China to more comprehensively develop its service and consumption economy.

source: https://web-assets.bcg.com/a1/00/f3778a2a4c1baaa2fc7733a00690/mind-the-generation-gap.pdf

In the short term, it is true that China consumers has been very cautious, as retail sales have not kept up with the increase in household deposit since Covid (see chart below).

Source: bloomberg

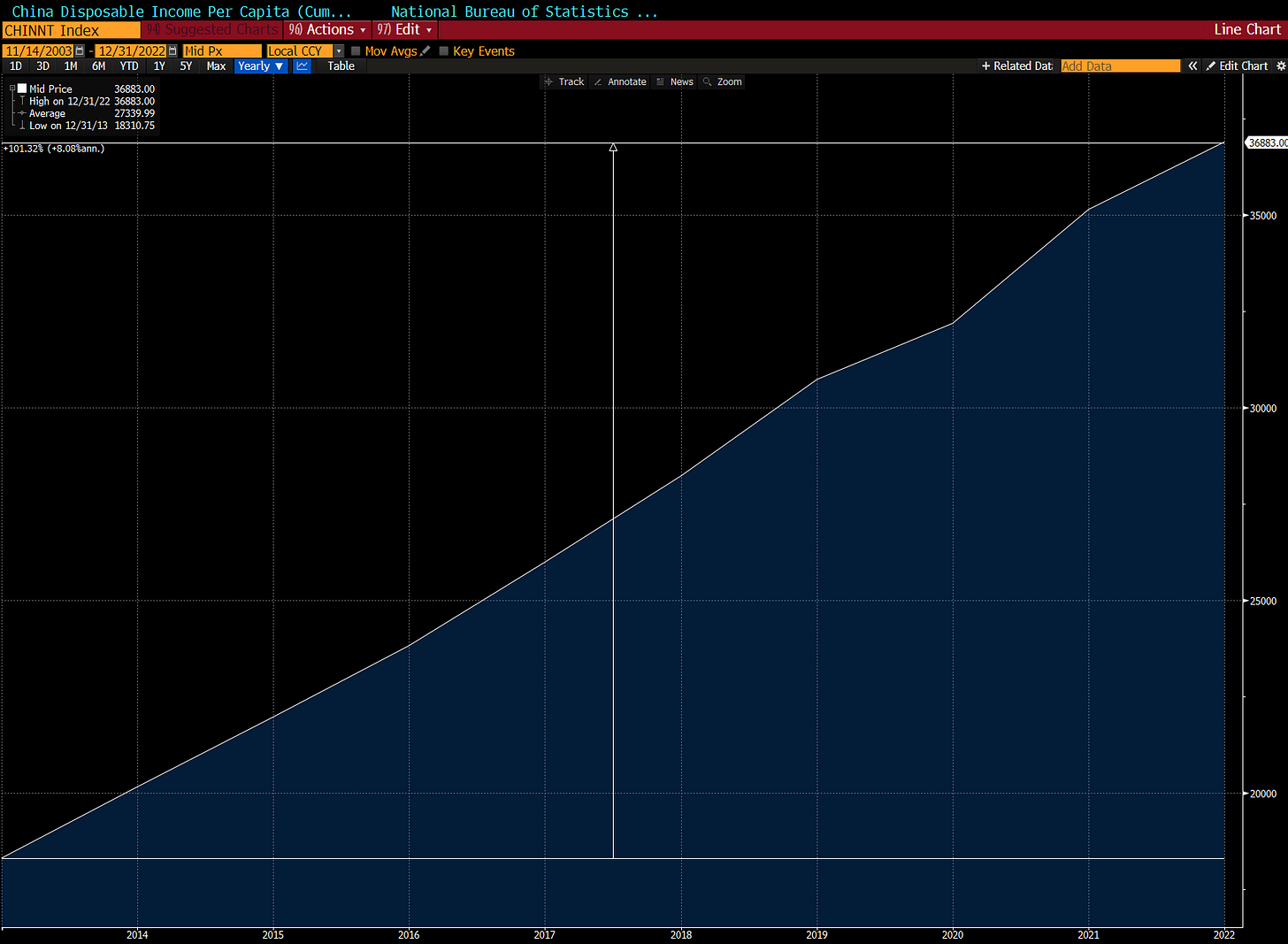

In the medium term, retail sales will recover as long as disposable income continues to grow, even though the growth rate in the future will likely be lower than in the past (see below). Buffett famously said that “investing is forgoing consumption now in order to have the ability to consume more at a later date.” Saving is the same; consumption will eventually catch up.

Source: Bloomberg

Transformation of China Economy

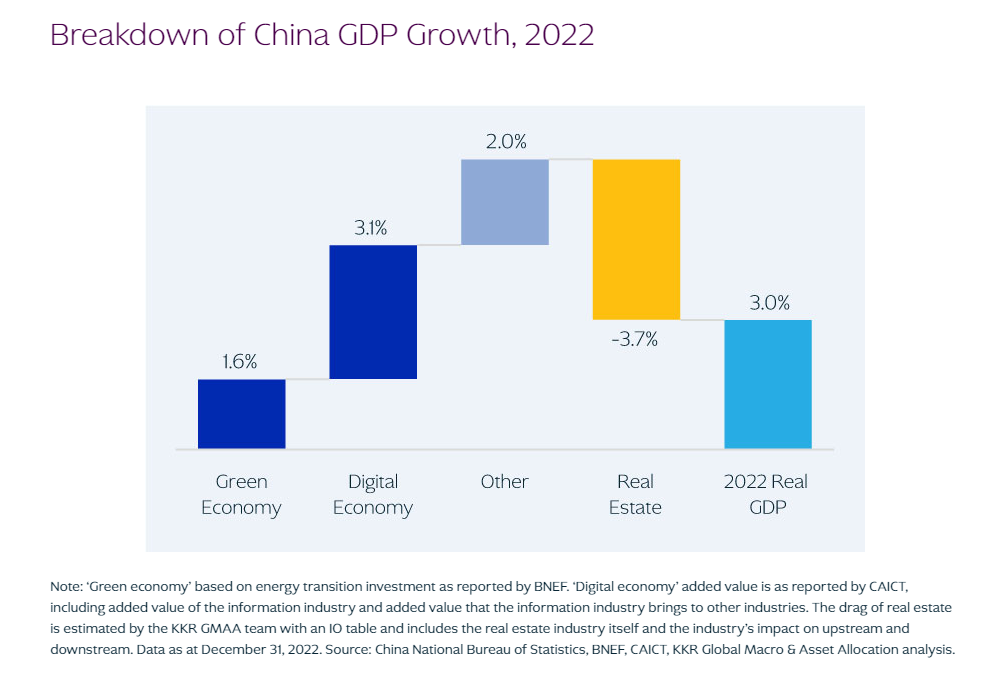

The dynamics of the Chinese economy have been changing, and this change will accelerate further. Real estate, fixed investments, and low-value exports (such as t-shirts and toys) that drove China’s economic growth in the past 20 years are being replaced by digital and green economies, as well as high-value exports produced by advanced manufacturing (such as EV batteries, cars, and solar panels). The chart below from KKR illustrates this transformation based on the breakdown of 2022 GDP growth (see below):

Source: https://www.kkr.com/insights/thoughts-from-the-road-asia-october

As investors, we don't buy the economy, nor do we need to acquire the entire market. This transformation will create both winners and losers; it's crucial to focus on the emerging leading sectors in the economy and overlook past successes. For example, in less than three years, China increased its auto exports by approximately 350% and recently surpassed Japan and Germany to become the world's largest car exporter. Who would have predicted that Europeans would be driving cars made in China? This kind of disruption undoubtedly attracts geopolitical attention, but consumers always seek a good price/value proposition irrespective of politics.

Source: FT

Seismic Shift

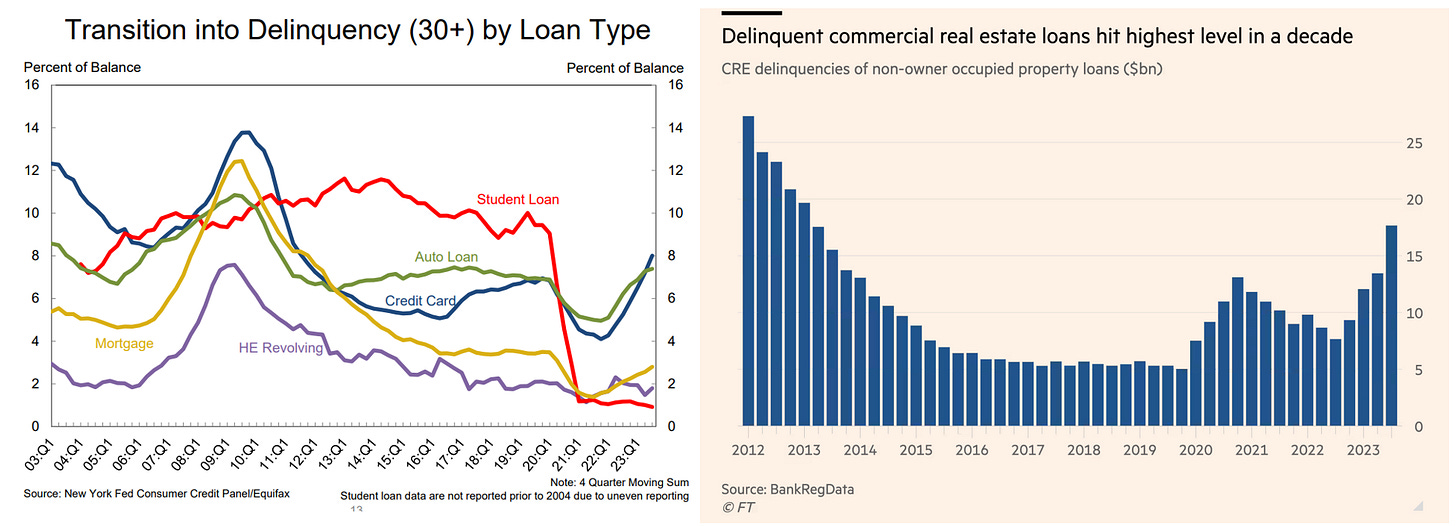

To conclude Journal #7, I'd like to return to the topic of the US bond market, which was the focal point in Journal #6, as a seismic shift appears to be taking place. Firstly, a series of October data releases indicated a concerning rise in delinquencies in credit card loans, auto loans, and commercial real estate loans (see below).

source: https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2023Q3 and FT

Specifically, the commercial real estate market, which I discussed in Journal #1, is rapidly deteriorating. The data in the FT chart above does not account for the impact of the WeWork bankruptcy filing last week. WeWork is a significant partner for many landlords in various cities; its bankruptcy could enable "WeDidn’tWork" to renegotiate all its leases at a substantial discount or, in the worst case, to terminate lease contracts prematurely.

Based on two anecdotal pieces of evidence below, office buildings are already selling at deep discounts, possibly just based on land values. Next year, approximately $500 billion of commercial real estate (CRE) loans will mature. Things will likely worsen before they get better.

Secondly, the US job market is also showing signs of weakening. One of the more reliable recession indicators is known as the Sahm Rule. The rule is straightforward: when the three-month average of the unemployment rate is 0.5% (or more) above its low over the previous 12 months, we are in the early months of a recession. Let me emphasize: once triggered, we are IN the early months of a recession, not that a recession will come at some point.

Since the 1960s, this indicator has only had one false positive. In that one false positive in 1970, the recession did come, just three months after (see below). Last week, the US unemployment rate increased to 3.9%, and the past 12-month low was 3.4%. Hence, if the US unemployment rate just stays at 3.9% for the next two months, the Sahm Rule will trigger. A weakening job market combined with a deteriorating delinquency trend paints a very challenging picture; the next three to six months will be very interesting. Enjoy the year-end rally now, but be careful heading into 2024. As always, thanks for reading.