Greetings and Happy Fall. For Journal #6, I'd like to focus on the Fed, the bond market, and the implications for "higher for longer".

Leading the Federal Reserve hasn't been an easy task over the past three years. The COVID-19 outbreak was a truly unprecedented event, with no modern historical precedent. All things considered, I believe Chairman Powell has done an admirable job in steering the US economy through the challenges posed by COVID-19. Regrettably, in today's era of pervasive social media, our collective memory tends to emphasize missteps more than successes.

Much like other notable figures who've had their share of infamous misjudgments, Chairman Powell may forever be linked with his misjudgment on "transitory inflation." Powell's roughly 10-month miscalculation (from March '21 to November '21) led us into the highest inflationary period witnessed in the past four decades (see chart below). In order to combat this surge in inflation and to redeem his reputation, he orchestrated the swiftest and most significant interest rate hike in the past 40 years. The question that arises now is: where does inflation stand? And what has caused the resurgence of bond vigilantes in recent months?

War on Inflation

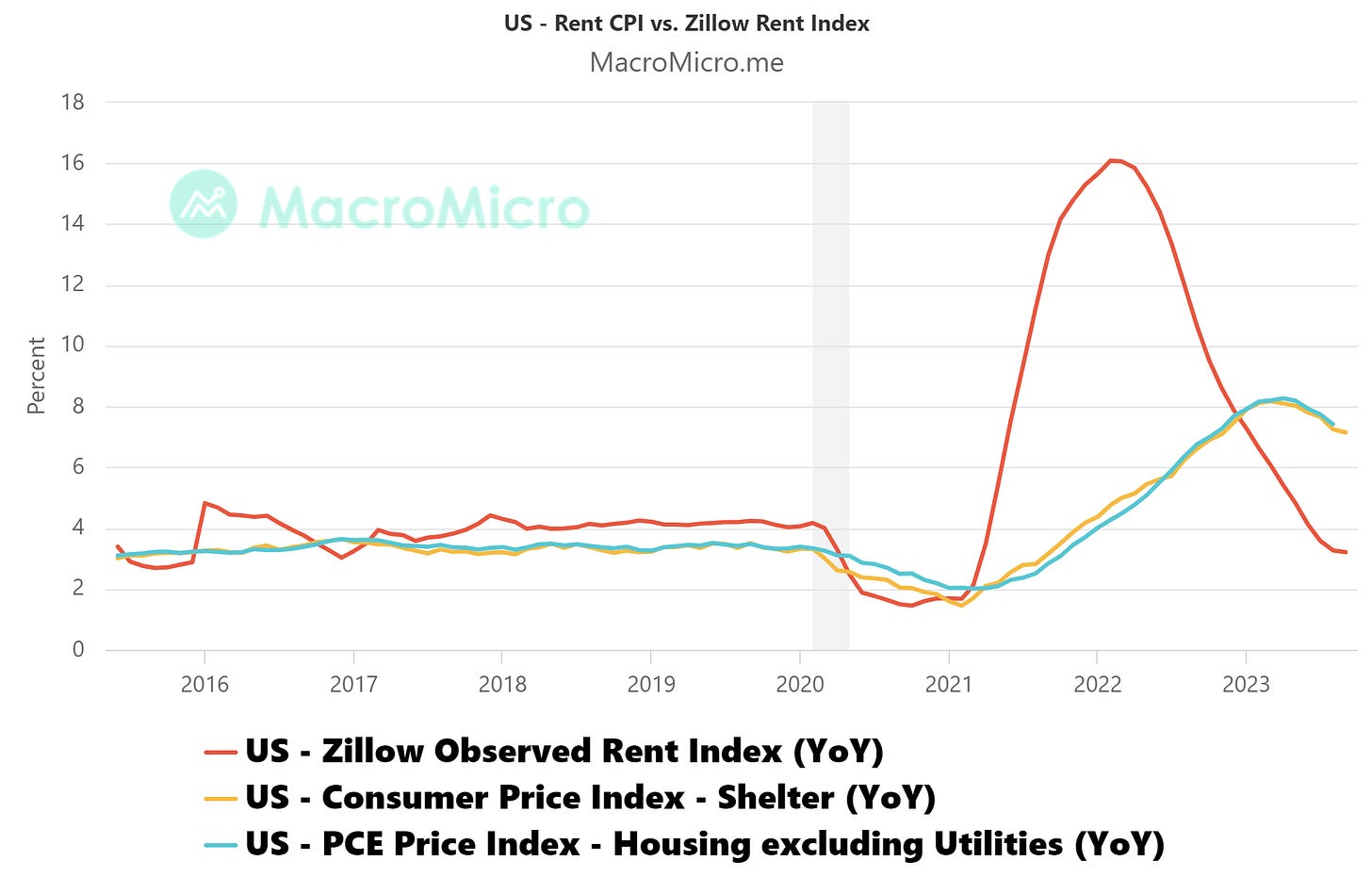

While it's always risky to declare victory in the battle against inflation, I would dare to say that we are approaching that point. My optimism stems from the fact that, by replacing the shelter component of the core CPI with real-time rental data from sources like Zillow or ApartmentList—rather than relying on the government's delayed rent data—the core CPI has consistently remained well below the Fed's 2% target for the past several months, as illustrated below.

Source: https://x.com/jasonfurman/status/1712454204474704181?s=20

The reason the government rent data lags behind is that it encompasses rent prices from both existing and new rental contracts, whereas the Zillow index solely focuses rent prices from new rental contracts. Consequently, when rents began to surge significantly in 2021, the government data was delayed in reflecting the inflationary pressure compared to the Zillow index, as demonstrated below. As rent inflation started to taper off in real-time by mid-2022, the government data is now slowed to reflect the current reality.

Source: https://en.macromicro.me/collections/5/us-price-relative/49740/us-cpi-rent-zillow-rent-yoy

At the same time, I am hesitant to declare victory over inflation, given that geopolitical events could easily and suddenly disrupt supply chains or energy prices. As the tragic events in Israel continue to unfold, if Hamas's assault on Israel escalates into a broader regional conflict, it could pose a risk to inflation worldwide. The ongoing war in Ukraine also has the potential to escalate to a higher level. Nevertheless, setting aside geopolitical risks, I believe that inflation risk based on economic factors is currently subdued.

The Bond Vigilantes Came Back with a Vengeance

Despite inflation data showing a downward trend, bond vigilantes have made a strong resurgence in the past few months. Why is this the case? Some commentators have suggested that the escalating US deficit has led to a sharp increase in treasury issuance this year, resulting in a demand/supply imbalance. However, both the SIFMA treasury net issuance data and the 10-year Treasury bid-to-cover ratio (which monitors supply and demand at treasury auctions) do not substantiate such a narrative.

10Y Treasury Bid to Cover Ratio (source: Bloomberg)

SIFMA Treasury Net Issuance (source: https://www.sifma.org/resources/research/us-treasury-securities-statistics/)

Indeed, it is true that the growing US deficit resulted in a net uptick in treasury issuance. However, the majority of this increase occurred at the T-Bills level. Treasury Notes (ranging from 2 to 10 years) actually experienced a net decrease in issuance year-to-date. Simultaneously, the net issuance for T Bonds (ranging from 10 to 30 years) during this period was lower compared to the same period last year, as illustrated in the table above.

Therefore, from my perspective, the significant surge in the 10-Year yield in recent months can largely be attributed to the resolute message Powell delivered during the last Fed meeting about "Higher for Longer." While this narrative might be viewed as necessary for Powell's redemption, it also carries the potential to backfire.

1) Higher for Longer Increases the Likelihood of Economic Accidents:

According to S&P Global, year-to-date, US bankruptcy filings have already exceeded the levels recorded for the entire years of 2021 and 2022. The current bankruptcy rate is on par with that of 2020, when the US economy faced lockdowns due to the pandemic. Post-Covid, an unprecedented amount of fiscal and monetary stimulus was injected into the economy. Now, with the "higher for longer" narrative in play, it's likely that bankruptcy cases will continue to rise. Thus far, these bankruptcies have primarily involved small companies and haven't triggered a broader credit event or systemic risk capable of destabilizing the economy or capital markets. However, the risk of a significant economic upheaval grows the longer we remain in this "higher for longer" phase.

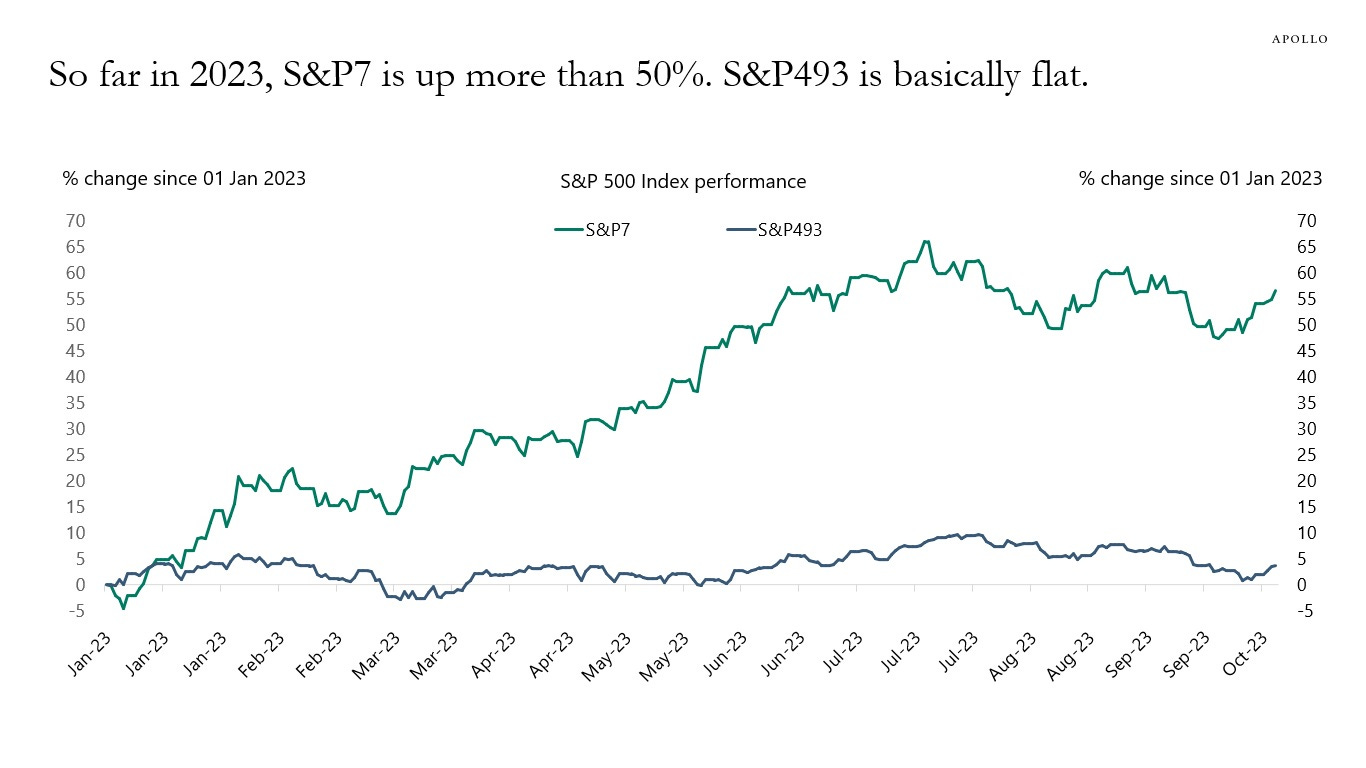

2) Higher for Longer Will Exacerbate the Current Bifurcated Stock Market:

The "Magnificent 7" or "Mag 7" (the top 7 stocks in the S&P 500) are essentially the only stocks that any investor needs to own this year. The Nasdaq-to-Russell 2000 ratio (small-cap) is approaching levels of extremity similar to those observed in 1999/2000. Such extremes are never conducive to a healthy market; they're like rubber bands stretching further and further until they inevitably snap.

Mag 7 vs S&P 493 (source: Apollo Academy)

The ratio of Nasdaq to Russell 2000 (source: Bloomberg)

This phenomenon makes sense in the short term, given that the Mag 7 generate substantial cash flows, do not rely on borrowing, and are not impacted by the current higher for longer rate environment. On the contrary, average companies, especially smaller ones, are witnessing record-level increases in their interest expenses (as shown below).

Coupled with the fact that almost half of all publicly traded companies, particularly smaller ones, are operating at a loss (see below charts), a "higher for longer" scenario is likely to perpetuate investor bias towards the Mag 7, thus intensifying the stretching of this "rubber band" to its limits. These unprofitable, zombie-like companies may have managed to stay afloat during the period of zero interest rates. However, when their loans or bonds come due, and they need to refinance in the current higher-for-longer rate environment, bankruptcy might emerge as their sole recourse.

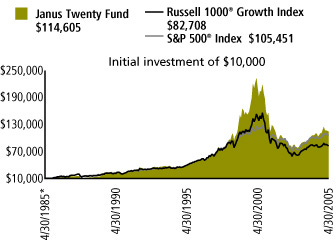

Back in the late 1990s, during my early days as a portfolio manager, the Janus Twenty fund, which invested in the largest 20 growth/tech companies of that era, held a position similar to today's Mag 7. Many clients of mine were enamored with it and couldn't seem to get enough. The AI hype, as discussed in Journal #5, wasn't the sole reason why I felt this past summer resembled the summer of 1999; the market dynamics today mirror those of the late 1990s as well. As the chart below shows, investors at the Janus Twenty fund did not fare well if they invested at the peak.

Powell Redemption

Investing is a humbling endeavor, where even top investors find themselves correct only about 55% of the time. This implies that the remaining 45% of time is spent either being early or being wrong. I must acknowledge my own misjudgment regarding treasury bonds, assuming the Fed would have pivoted by now.

Nevertheless, I maintain my view that a soft landing is unlikely in 2024, and the possibility of a "no landing" outcome may be limited to companies like the Mag 7, which do not rely on external financing. However, for the vast majority of consumers and companies that rely on financing, an environment of "higher for longer" interest rates will only further stretch the "rubber band" to its limits and potentially lead to its breaking point.

While Powell may have redeemed himself from his "transitory inflation" misjudgment, if an economic accident were to trigger the snapping of this rubber band, leading to a hard landing, he might require another redemption for his "higher for longer" decision. Only time will tell whether it's his misjudgment or mine. Regardless, statistically speaking, bond yields at close to 2% standard deviation (or z-score) only happened a few times in the past 30 years, it had rewarded patient investors in the past.

Thank you for reading, as always.