I'm delighted to be writing to you from the beautiful state of Hawaii, where I spent my formative teenage years. It brought me immense joy to celebrate my mother's 85th birthday last week, and this week has been equally enjoyable as I've taken to the golf courses for a few leisurely rounds in Oahu. At the same time, I am deeply saddened by the images and videos of the Maui fire. If you'd like to provide assistance, you can contribute to the United Way Maui Fire Relief Fund. Here is the link: https://mauiunitedway.org/disasterrelief

China's Bumpy Path to Recovery – Stay Tune

In my previous journal entry, I delved into the intricate landscape of the Chinese economy. My central concern revolved around whether Xi's China would foster the growth of private enterprises while maintaining the overarching control of the CPC. Just days after my article was published, I was glad to see a resounding proclamation from the very top of the Chinese government, underscoring the paramount importance of the private sector. (You can find the comprehensive statement here: http://www.news.cn/politics/2023-07/19/c_1129758014.htm).

This development, while not an unequivocal assurance of an immediate and seamless recovery, does alleviate my main China concern about a nightmarish scenario, akin to the Soviet Union's economic quagmire in the 1970s, based solely on state planning and state enterprises. It was during that era that a wry saying emerged among Soviet workers: "We pretend to work, and they pretend to pay us." That model did not work for Soviet Union, and will not work for China. Deng’s China model worked well in the past 40 years, and it should continue to work. For him, “It doesn’t matter it is a black cat or white cat, if it can catch mice, it's a good cat." State enterprises are needed for certain functions, but private enterprises are the ones that catch “mice.”

The US Economy: A Glass Half Full or Half Empty?

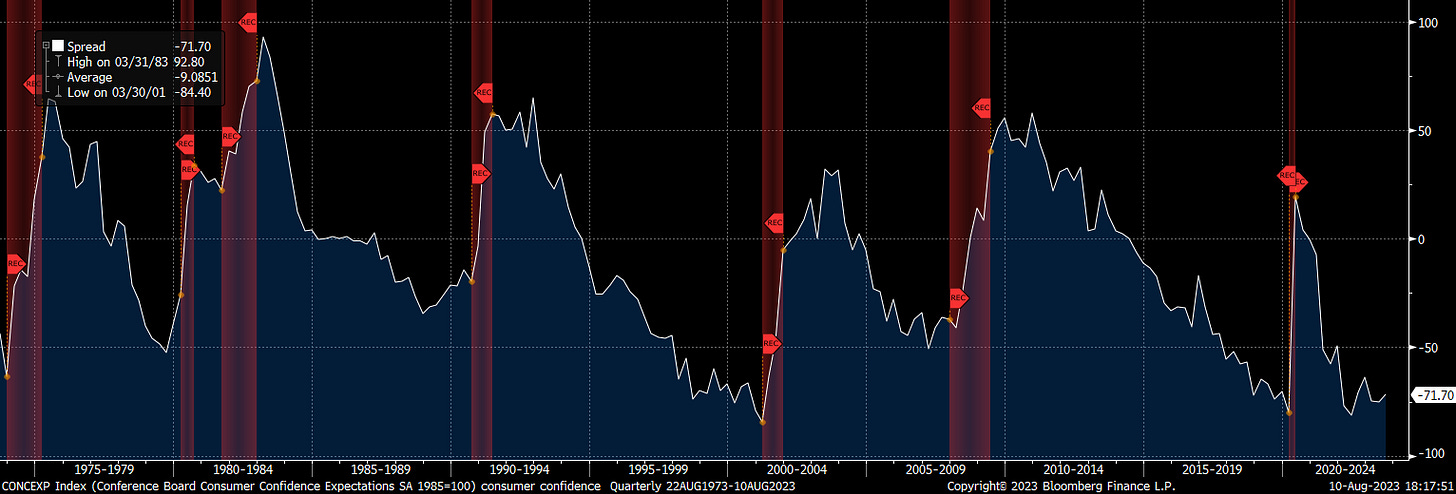

For Journal #4, I would like to shift the spotlight onto the US economy. The first half of 2023 has unveiled a slew of positive surprises on the US economic front. Employment figures and various other economic indicators have consistently outperformed expectations, propelling the US equity market to recovery, bolstered in part by the AI frenzy. However, the landscape is far from simple, as all the conventional indicators of an impending recession – ones that have historically served us well – are blazing with alarming crimson. These red flags include the disconcerting inversion of the yield curve, a ten-month descent of the Leading Economic Index (LEI), and a persistently subdued consumer confidence. (Please refer to the accompanying charts below, where the shaded red areas were periods of US recessions.)

10 Year Treasury Yield minus 2 Year Treasury Yield

LEI Index YoY Change

Consumer Confidence: Expectations – Current Condition

Source: Bloomberg

The US Auto Industry as a Microcosm of the Economy

What's the current status of the US economy? A notable shift has occurred among Wall Street economists and strategists, with half of them transitioning from the "recession" camp to the "soft landing" camp. In my perspective, those embracing the soft landing outlook see the glass as half full, whereas those who still adhere to the recession outlook see it as half empty. The following charts vividly illustrate these contrasting viewpoints within the US auto industry, which serves as a miniature representation of the broader US economy, in my view.

1) The industry displays robust healthy growth, evident from a remarkable 13% increase in sales during the first half. (glass half full)

Source: The Wall Street Journal

2) However, at the same time, auto credit availability has been on a gradual tightening path on a year-over-year basis. (glass half empty)

Source: https://www.coxautoinc.com/market-insights/july-2023-dealertrack-cai/

3) Additionally, there's a concerning trend emerging as auto loan delinquencies are on the rise, drawing unsettling comparisons to 2007/2008. (glass half empty)

So, how do we characterize the current state of the US auto sector—glass half full or half empty? The impressive first-half sales undoubtedly lean towards the optimistic side, yet the declining availability of credit and the upward trend in auto loan delinquencies raise valid concerns. After all, the majority of individuals don't make car purchases outright in cash. Moreover, the rise in both car lease rates and loan rates due to the Federal Reserve's ongoing rate hikes could dampen car demand in the future. Equally puzzling is the surge in auto loan delinquencies during a period of full employment. One can only imagine the extent of the delinquency rate should unemployment rate heading higher.

Excess Savings in the US Drives Economic Growth

Despite the Federal Reserve having executed the most significant interest rate hike in the past 40 years, the reason why the US economy remained strong, in my view, was primarily due to the surplus savings from Covid stimulus. At the peak, these excess savings from Biden's stimulus checks amounted to $2.5 trillion, which was roughly 10% of the US GDP. These excess savings were the growth engine for the US economy for the past 2 years, as roughly 70% of the US GDP is based on consumption. The good news is that there is still around half a billion dollars of excess savings left, mainly concentrated in the top half of households by income, as shown in the charts below.

Unfortunately, the bottom half of households by income had already depleted their savings, which is the reason why credit card debts are reaching a record high (just surpassed $1 trillion) and credit card delinquency (as well as auto-loan delinquency, as discussed before) is also on the rise, as shown in the charts below.

In my opinion, the US economy will still be in the "glass half full" phase in Q3, as excess savings still amount to ~$500 billion, roughly 2% of the US GDP. However, moving towards the end of Q4 or perhaps the beginning of Q1 next year, the US economy will gradually appear "emptier" as the last $500 billion of excess savings is expended. That will be the time that truly reveals whether the "soft landing" camp or the "recession" camp prevails.

My wager is with the recession camp, considering we are already operating within a highly restrictive bank lending environment (see chart below; the second lowest in 50 years), and unfortunately, banks are projected to become even more restrictive based on the latest senior loan officer survey. FactSet perfectly summarized the survey's findings, stating that "tightening of credit standards has only been this broad ahead of (or during) recessions. The tightening is not only broad across banks but across loan types: C&I, CRE, and consumer." (Source: https://insight.factset.com/youre-gonna-need-a-bigger-boat-recession-implications-of-tightening-bank-credit-standards)

To compound matters, consumers burdened with outstanding student loans ($1.6 trillion in aggregate) are scheduled to resume payments in October following a pause of over 3 years (see article: https://www.cnn.com/2023/06/30/politics/school-loan-payments-due-october/index.html). A perfect storm seems to be coalescing, particularly for the lower half of US households by income. In essence, when bank accounts are depleted and banks are reluctant to lend, troubles begin.

A Tale of Two Economies

This is a tale of two economies: one economy where people have money in the bank but are hesitant to spend, and another economy where people are depleting their last excess savings. This embodies the yin and yang of the world's two largest economies. In the next journal, I will discuss the market implications on the back of the macro environments of these two countries. Thank you for reading, and enjoy the remainder of your summer.