Firstly, I would like to express my gratitude for the positive feedback and encouragement I received regarding my first journal entry. It was a pleasant surprise to see it surpass 500 views, especially considering that I didn't engage in any social media marketing as recommended by Substack.

In my previous journal entry, I discussed the challenges looming over the US commercial office real estate sector. For this second entry, I intend to shift my focus towards the US residential housing market. Despite the possibility of short-term obstacles preceding an upcoming recession, I maintain a highly optimistic outlook on long-term investment opportunities in US residential housing.

Ten-Year Investment Thesis

Back in 2011, I developed a strong bullish sentiment towards US residential housing based on two primary sets of data: 1) US population by generation, and 2) US Housing Starts.

The US population by generation chart below illustrates that millennials constitute the largest generation, boasting over 72 million individuals. In 2011, the oldest millennials celebrated their 30th birthday. It was my belief at that time that as millennials entered their thirties, they would naturally desire their own homes instead of living with their parents or roommates. Consequently, this would lead to an escalating demand for housing in the years ahead.

US Population by Generation

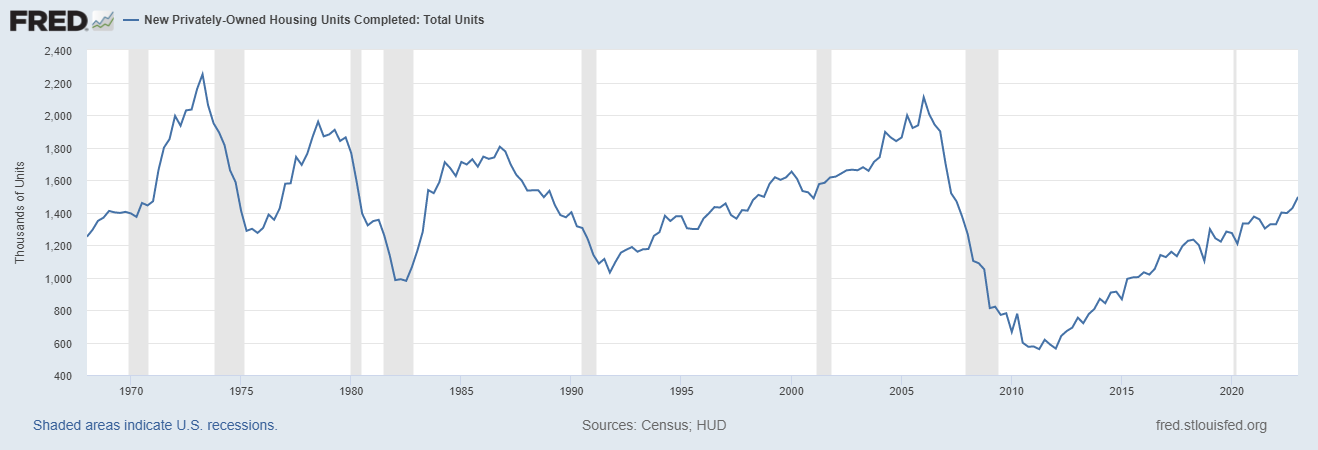

On the contrary, following the Great Financial Crisis of 2008/2009, US housing starts, which measure new residential construction, plummeted to unprecedented lows. The level reached during that time was even lower than the lowest point witnessed in the preceding 50 years of recessions. At that moment, I had no insight into the rate at which US housing supply would recover. However, my belief was that a few years of exceptionally limited new supply, combined with the increasing demand from millennials over time, would create an opportunity for double-digit Internal Rate of Return (IRR) with leverage. Additionally, the post-global financial crisis period presented bargain prices in US housing in 2011, offering an attractive entry point that had not been seen in years.

Unknown to me at the time, the environment of near-zero interest rates and money printing throughout the majority of the last decade further fueled the price recovery in the US housing market. Here in Los Angeles, for instance, prices have increased approximately 2.5 times since the lows of 2011/2012, resulting in high single-digit to low double-digit IRRs before leverage. With the inclusion of leverage, the IRRs escalated to mid and high double-digit returns. These figures solely represent price appreciation IRRs and exclude net rental yield from the calculation.

Next 10 years

After reexamining the housing investment thesis in light of the substantial price increases, particularly within the last three years, I was surprised to find that my bullish outlook remains unwavering. Here are the reasons supporting my continued optimism:

1) US household formation:

In contrast to regions like Europe, Japan, and now China, where population decline has become a concern, the US continues to experience population growth, leading to a consistent increase in household formation. Over the past five and ten years, the compound annual growth rate for US household formation has stood at 2% and 2.7% respectively. Although the growth rate dipped below 2% in the last three years, it is reasonable to attribute this decline to the influence of the Covid-19 pandemic. As long as the US sustains population growth and ongoing household formation, the demand for housing will continue to rise. Additionally, considering that the oldest millennials are now in their early 40s, I believe they will seek to upgrade their living space, further fueling the demand for housing.

2) US Housing Shortage:

More importantly, while we witnessed a robust price recovery in US housing, the new housing supply over the past 12 years has been significantly below the levels seen in the previous 40 years, as illustrated in the chart below.

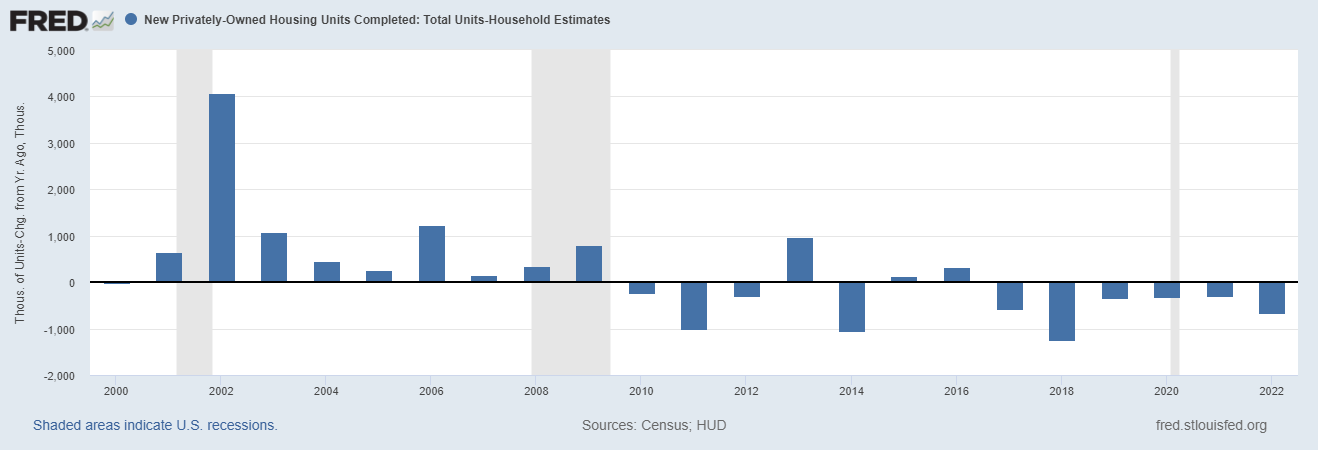

In fact, when comparing the number of housing units completed relative to new household formation in the chart below, it becomes evident that during the decade of the 2000s, there were more housing units completed than new household formations each year. However, for the majority of the past 12 years, the situation has been the opposite, with more household formations than total housing units completed. Cumulatively, this has resulted in a shortfall of five million housing units in new home construction over the past 12 years based solely on new household formation.

Housing units completed minus household formation

3) Aging Housing Stock:

Lastly, houses in the US in general are getting old. More than 60% of the total housing stock in the country was built before the 1980s, whereas only 10% of houses were constructed after 2010.

It is worth noting that houses in the US are typically constructed with materials such as wood, sheetrock, plaster, and drywall, as opposed to the concrete structures commonly found in Asia. 40+ year old houses often require substantial investments and ongoing upkeep, which can be a deterrent for potential buyers or existing homeowners seeking to avoid such responsibilities. Considering the situation, one would have expected a notable rise in new construction projects completed in the past decade, addressing both household formation and the need for replacement of aging houses. Regrettably, it did not happen.

Hence, when we combine the favorable demographic trends and household formation growth with the cumulative housing shortage over the past decade and the aging housing stock, I expect the residential industry will benefit from a significant tailwind over the next 10 years, despite potential short-term challenges associated with the upcoming recession.

However, there are notable differences compared to 2011. One key distinction is that house prices are no longer considered bargains. In fact, they have become expensive relative to income levels and the current interest rate environment. Moreover, I believe we should not expect a repeat of the decade-long period of ultra low interest rates and money printing seen from 2009 to 2021. Consequently, while I still anticipate gradual increases in housing prices over time, I do not foresee the same magnitude of double-digit IRR opportunities in housing prices as we had in the past decade.

So, how can we benefit from the tailwind in the US residential housing market over the next decade? Consider the home improvement market and the two juggernauts of the industry: Home Depot and Lowe's. I held shares of Home Depot from 2011 until earlier this year and achieved high teens IRRs during that period. While I recently sold my position due to anticipated short-term cyclical headwinds associated with the upcoming recession, I will reacquire it and potentially add Lowe's to my portfolio at some point in the future.

One of the remarkable aspects of these two companies is their negative equity on the balance sheet. Typically, negative equity is associated with companies burdened by substantial debt and accumulated losses, resulting in their liabilities exceeding their assets. However, Home Depot and Lowe's belong to the exceptional 0.001% of cases. These companies are highly profitable and generate significant free cash flow, enabling them to use stock buybacks and dividend payments to gradually reduce their equity to negative territory (Home Depot has experienced fluctuations between positive and negative equity in recent quarters).

As seen in the charts below, for instance, Lowe's has utilized its free cash flow over the past 10 years to repurchase shares, resulting in a decline in its book value of equity from $12 billion to -$15 billion. Throughout my three-decade investing career, I have encountered only a few companies with such a unique characteristic.

I will patiently wait for the upcoming cyclical headwinds to present an opportune moment to acquire these outstanding businesses at an attractive price. In the meantime, I wish you good health and safety. As always, thanks for spending the time to read this journal. Stay in touch!