In the weeks leading up to the U.S. Presidential election, like many other investors, I positioned myself for the "Trump trades" after betting market odds for a Trump victory surged to 65%, accompanied by rising chances of a Republican sweep in Congress. Now, more than a month since the election, U.S. investors are still reaping the benefits of its outcome.

That said, I find myself asking: how much further can Trump’s policies drive an already overpriced U.S. equity market?

In this journal, I will analyze key aspects of Trump’s potential economic policies, which I have categorized as the good, the bad, and the wild card.

As always, thank you for reading, and have a wonderful holiday season.

The Good - Tax Cuts

There’s no doubt that U.S. investors favor a Trump victory. After Trump’s surprising win in the 2016 election, the S&P 500 rose approximately 5% in the two months following November 8, 2016, and continued to rally another 22% in 2017. Similarly, since election day on November 5, 2024, the S&P 500 has climbed ~5%—even before factoring in the pre-election run-up in U.S. equity markets.

Among Trump’s many proposed economic policies, a corporate tax cut stands out as having the most direct and tangible benefits. If the corporate tax rate is reduced to 15% from the current 21%, as he suggested on the campaign trail, it would immediately translate to a 6% increase in corporate earnings.

Another notable aspect of his tax policy is the proposed return of unlimited itemized deductions for state and local taxes (SALT). Additionally, Trump has expressed interest in exempting Social Security payments, tips, and overtime pay from income tax. While the reinstatement of SALT deductions would primarily benefit the top 50%—given the significance of property taxes in state and local taxes—the latter exemptions would provide direct relief to the bottom 50%.

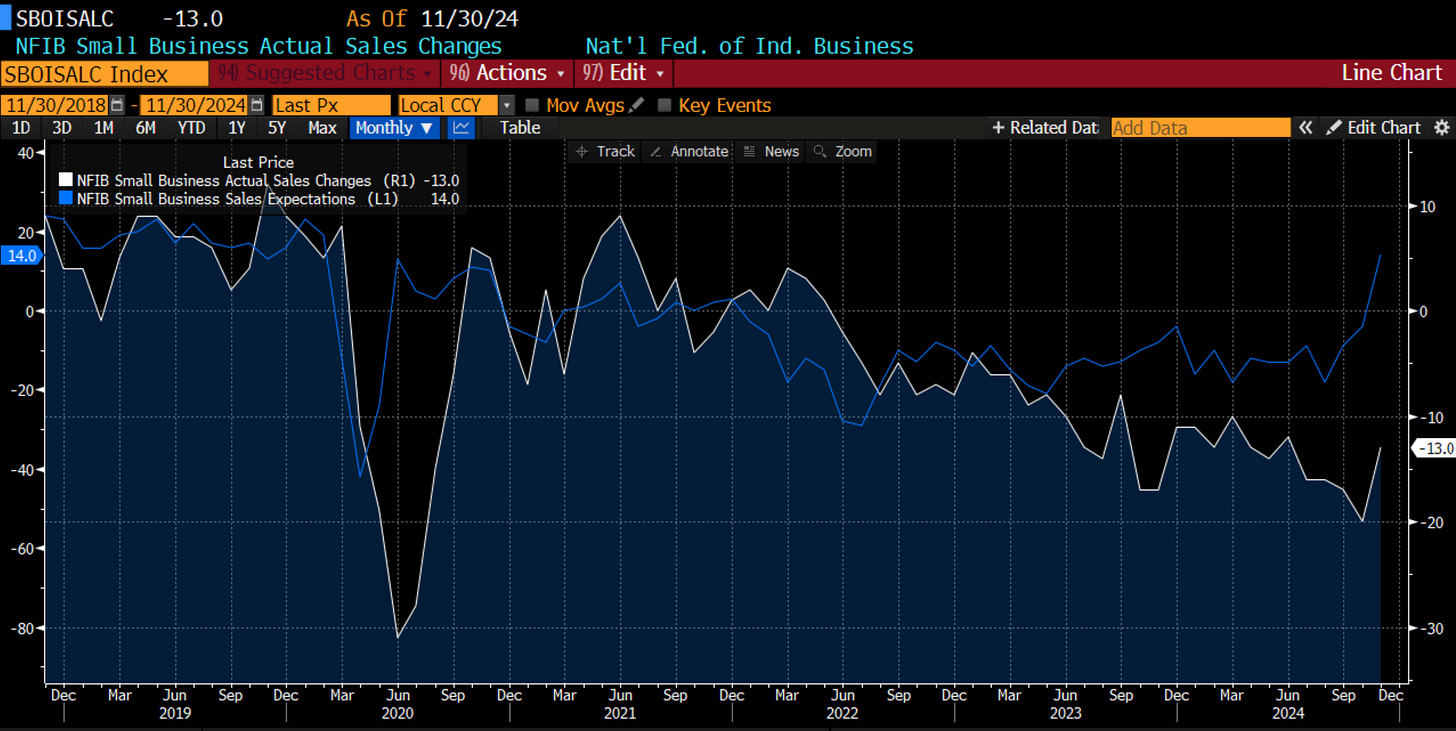

Perhaps this optimism is best reflected in the latest small business survey: “Our sales are subpar, but Trump is going to make it all great again” (see below).

Source: Bloomberg

The Bad – Trade Wars

"Tariff" seems to be one of Trump’s favorite words; however, to any serious economist, there is little to no argument that tariffs benefit the U.S. economy.

First, the fundamental law of comparative advantage—which states that a country should specialize in producing goods or services for which it has the lowest opportunity cost and trade for those it is less efficient at producing—highlights the clear benefits of free trade. Developed by David Ricardo in 1817, this principle has underscored the importance of international trade for over 200 years, demonstrating that mutual gains are not only possible but achievable, even between unequal economies.

Second, U.S. manufacturing jobs have been in decline since the end of World War II (see below), and no tariff will be enough to reverse this long-term trend. The slower rate of decline over the past 15 years is already a positive development. If Trump were to impose a 10% tariff on China and a 25% tariff on Canada and Mexico, retailers like Home Depot and Walmart would simply shift sourcing to alternative countries such as Vietnam, Bangladesh, or Indonesia. U.S. consumers are unlikely to pay inflated prices for basic goods, just because they are made in America.

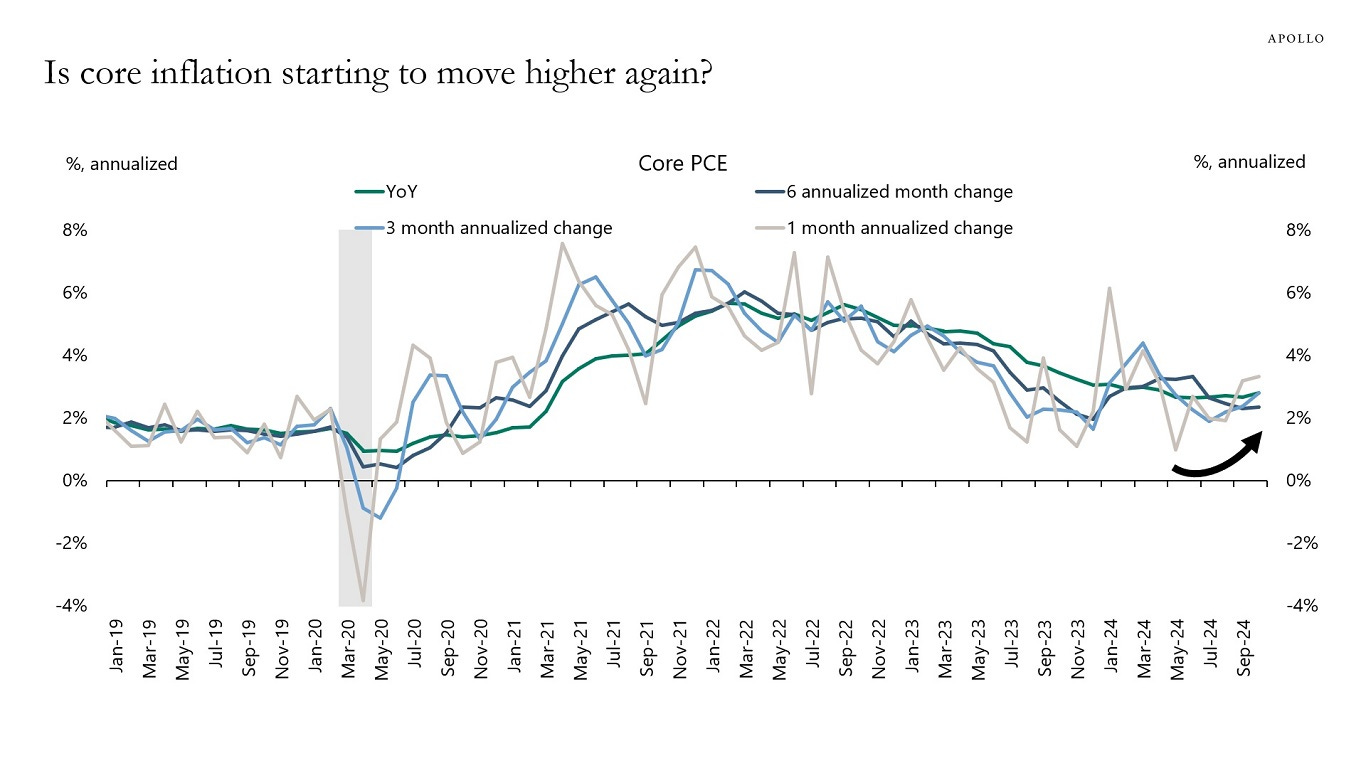

Third, while inflation has declined significantly from its peak two years ago, the final stretch of the inflation fight appears to be the most challenging. In recent months, core inflation has stalled its downward trend, with the 1-month annualized change now showing an upward trajectory (see below).

Source: https://www.apolloacademy.com/wp-content/uploads/2024/12/MeasuresOfInflation_121524_v4.pdf

The last thing the U.S. economy needs is a trade war with Canada, Mexico, and China that risks reigniting inflationary pressures. As Mark Twain famously said, “While history doesn’t repeat itself, it often rhymes.” We certainly do not want to see a repeat of the 1970s stagflation era (see below).

Source: https://www.apolloacademy.com/wp-content/uploads/2024/12/MeasuresOfInflation_121524_v4.pdf

The Wide Card - DOGE

Shortly after Trump’s election victory, he announced the creation of the Department of Government Efficiency (DOGE)—a somewhat misleading name, as it is merely an advisory body, not an official government department. What makes DOGE particularly intriguing is its leadership under Elon Musk, who arguably holds the largest microphone in the world today, alongside fellow billionaire Vivek Ramaswamy.

Their stated goals—slashing federal regulations, overseeing mass layoffs of government employees and contractors, and even shutting down entire agencies—bear a striking resemblance to the reforms Javier Milei pursued after his election as Argentina’s president a year ago.

Without delving into extensive details, Milei’s accomplishments over the past 12 months—through fiscal spending cuts, deregulation, and a fierce fight against inflation—can only be described as an economic miracle. While Argentina still grapples with significant structural challenges, Milei has had an exceptional start, and I believe he has the potential to achieve his own version of MAGA—Make Argentina Great Again—perhaps even more successfully than Trump.

This optimism is already reflected in key indicators such as the CDS market (a measure of Argentina’s sovereign risk—where lower is better) and the Argentinian stock market (see charts below).

Source: Bloomberg

Source: Bloomberg

Back to the U.S.—can Elon and Vivek cut regulation and fiscal spending like Milei did? No one knows. However, deregulation is likely the easier of the two tasks.

According to a Forbes article, the current volume of federal rules and regulations stands at nearly 100,000 pages—the highest level ever recorded (see below). While these pages guarantee the full employment of lawyers for years to come, I sincerely hope that Elon and Vivek can cut at least 10,000 to 20,000 pages. Having worked in and led businesses in federally regulated industries during my past life (banking and asset management), I can easily name a long list of regulations that serve no meaningful purpose—neither protecting consumers or shareholders nor ensuring fair competition.

Source: https://www.forbes.com/sites/waynecrews/2024/12/03/bidens-2024-federal-register-page-count-is-already-the-highest-ever/

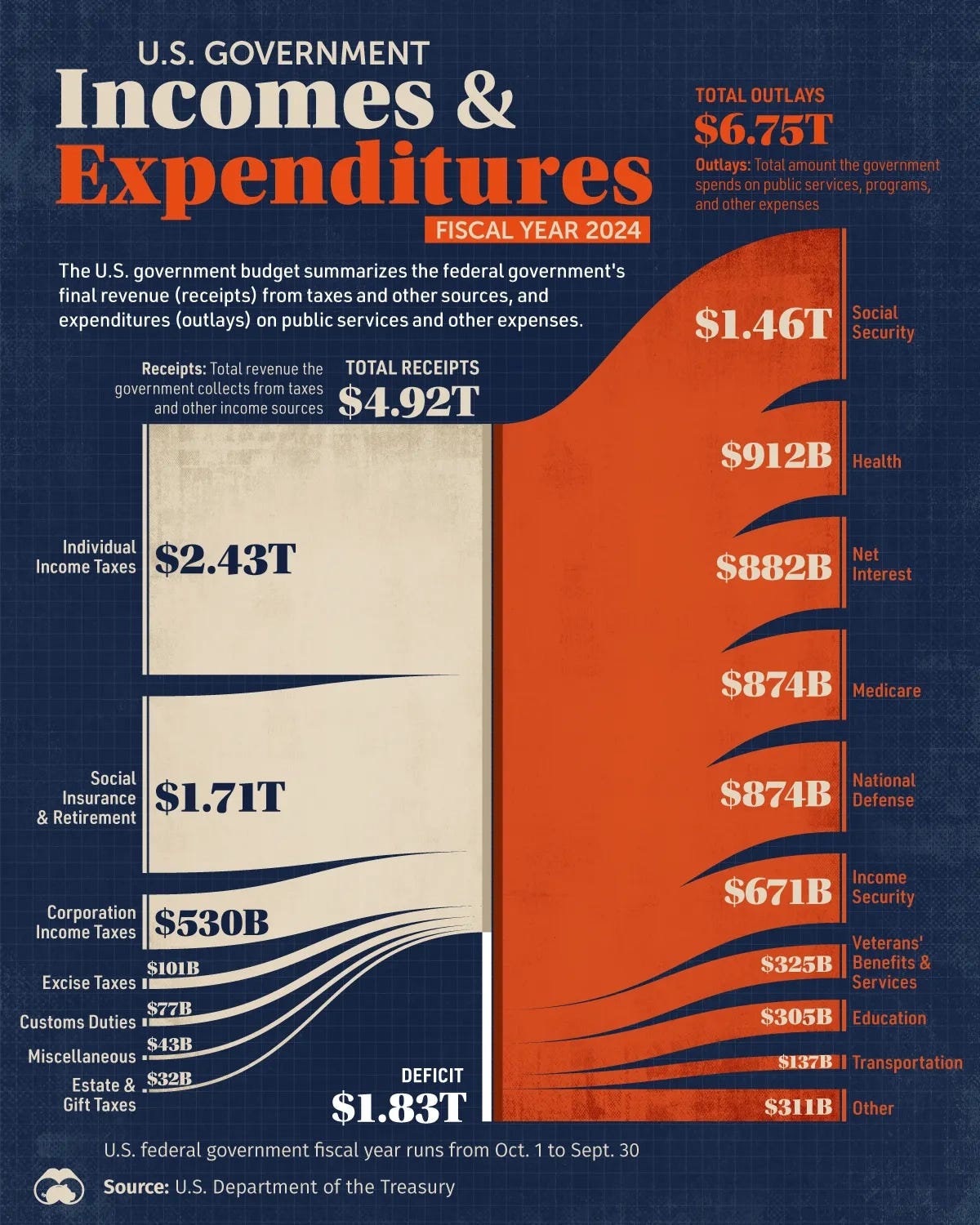

When it comes to the U.S. government budget, the challenge is immense. As shown in the picture below, most expenditures are mandatory, leaving little room for discretionary cuts. It’s hard to imagine how an advisory body with no real power in Washington—even one co-led by the smartest person on earth with the loudest microphone—could bring about drastic change.

Nonetheless, as an American, I am rooting for Elon and Vivek. If the trajectory of the U.S. budget deficit doesn’t shift, it won’t be long before the largest government expenditure becomes net interest payments—currently the third largest. And that is simply insane.

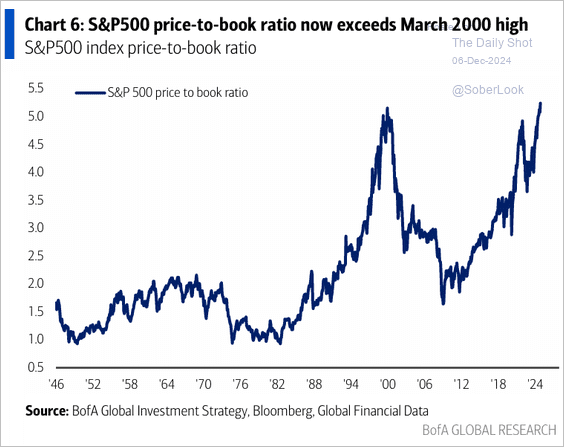

Back to my original question in the title—can Trump propel an overpriced market into the stratosphere? Sorry, folks, I simply don’t know. While I’m not selling any of my U.S. equity holdings today, I’m also not adding to my positions. The current valuation (see below) is simply too rich for my taste.

Source: Daily Shot

More importantly, Buffett’s cash position and the extreme bullish sentiment among retail investors simply give me the wrong vibe. As Warren famously said, “Be fearful when others are greedy. Be greedy when others are fearful.”

Lastly, who else is being fearful? Corporate insiders (see charts below).

As always, thanks for reading, and have a wonderful holiday season. Talk to you in 2025!

Great insights, Danny! Curious to know your thoughts on three things:

1) related to Doge, economic impacts of Federal cost cutting on both direct and indirect employment

2) Immigration - seems a wildcard and potentially stagflationary if not done thoughtfully

3) I struggle with comparisons to Argentina - I get that Milei is validating the Chicago School, and is a good reminder for the US. But Argentina couldn't be any more different from the US economically and monetarily (understatement). Seems the tactics should be fit for purpose.