Greetings! I hope everyone is enjoying the summer and the excitement of the Summer Olympic Games. In last month’s Journal #15, I predicted that the Fed would need to cut rates at the upcoming FOMC meeting. However, I didn’t anticipate the dramas and events that would follow. We were in the midst of a summer rally and the AI hype, after all. In this journal, I’ll review the unwinding of the yen carry trade, discuss the Fed's next move, and explore how to position yourself for the fall—a time of year that has historically been among the most volatile. As always, thanks for reading!

Yen Carry Trades

I first learned about yen carry trades during my early days at UBS in the 1990s. An international private banker mentioned that his clients in Latin America liked to borrow in yen due to its low borrowing costs and use the funds to buy U.S. bonds, which offered much higher yields. Given that my undergraduate studies at NYU Stern didn’t cover leverage—let alone yen carry trades—I was immediately intrigued and started asking a lot of questions. The most important one was, “What if the yen appreciates against the dollar? Wouldn’t that make the yen loan amount larger?” I vividly remember the technical response: “When that happens, you’re shxt out of luck.”

The complexity of yen carry trades lies in the fact that they’re not limited to buying higher-yield bonds. Borrowing at rock-bottom rates to buy Nvidia? Sure. Using cheap yen to buy Bitcoin? Why not? As a result, there’s no official record of how large the yen carry trades are today—Deutsche Bank estimated it at $20 trillion, which seems high, but it’s impossible to verify. However, considering we’ve seen the longest inversion of the U.S. yield curve (where short-term rates are higher than long-term rates) since July 2022, I’m pretty sure that the scale of yen carry trades today is larger than in the past.

The market drama of the past week resulted from a combination of factors: a weak U.S. jobs report that confirmed the Fed’s need to cut rates in September and a hawkish Bank of Japan threatening further rate hikes, leading to a stronger yen and an unwinding of yen carry trades. As shown in the Bloomberg chart below, as the yen strengthened from 160 yen/$ to below 150 yen/$, the net short yen positions (used as a proxy for yen carry trades) declined significantly.

So, the drama in the markets in the past week was a result of a combination of the weak US job report which confirmed that the Fed needed to cut rates in September and a hawkish Bank of Japan, threatening to raise rates further, which led to a strengthening of the yen and an unwinding of the yen carry trades. As the chart from Bloomberg showed below, as the yen started to strength from 160 yen/$ to below 150 yen/$, the net yen short position (used as a proxy of the yen carry trades) declined significantly.

Source: Bloomberg

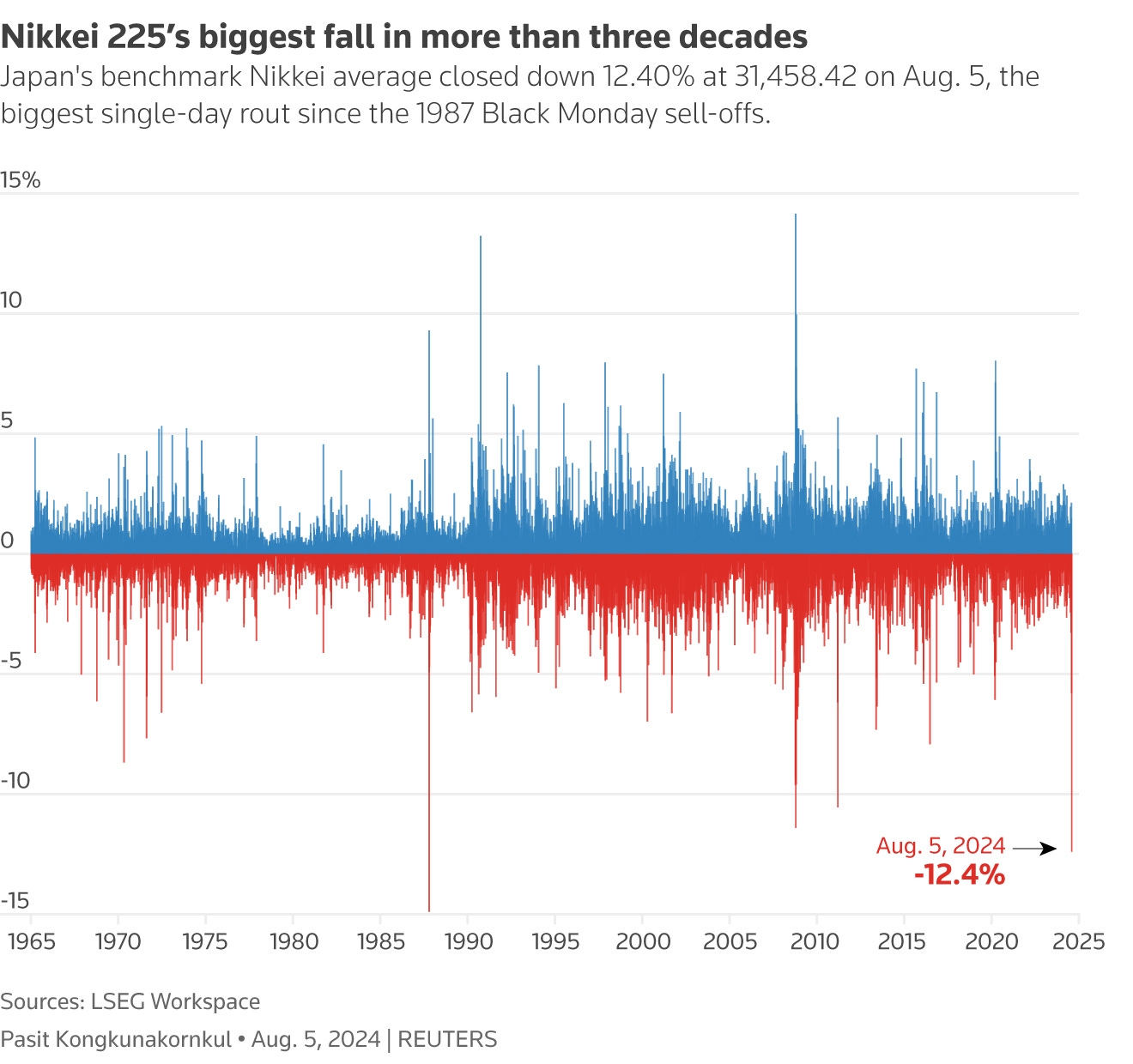

The good news is that the Bank of Japan has temporarily backed off from a rate hike after the Nikkei 225 experienced its biggest drop since the 1980s.

Source: https://www.reuters.com/markets/us/global-markets-milestones-graphic-2024-08-05/

However, the unwinding of yen carry trades may not be over. Based on past exogenous events, the yen could continue to strengthen, as the chart below suggests. If the yen resumes its upward trend, the unwinding of yen carry trades will likely persist. What we saw this past week might be just a preview of what’s yet to come. In other words, it’s unlikely that all the air built up in a bubble over two years could be released in just one week.

Source: Bloomberg

All Eyes on the Fed

Last month, I argued that weak U.S. economic data “is why I believe the Fed should cut rates now (July), instead of waiting until September,” even though consensus at the time didn’t see the need for a July cut. After a week of market turmoil, a wave of strategists and economists are now saying that the Fed is “behind the curve” and should have started cutting rates last month. Moreover, calls for a 50 basis point cut instead of a 25 basis point cut are growing, with some even suggesting emergency cuts between FOMC meetings.

However, there’s a dilemma: if the Fed becomes more aggressive with rate cuts, it’s likely that the yen will strengthen again due to interest rate differentials, which could further trigger the unwinding of yen carry trades.

Nevertheless, the financial conditions for the lower half of the wealth distribution in the U.S. have deteriorated to the point where a 50 basis point cut might be justified. Recent delinquency data for both credit cards and auto loans show levels now higher than at the beginning of 2008, when the financial crisis began.

Source: https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2024Q2

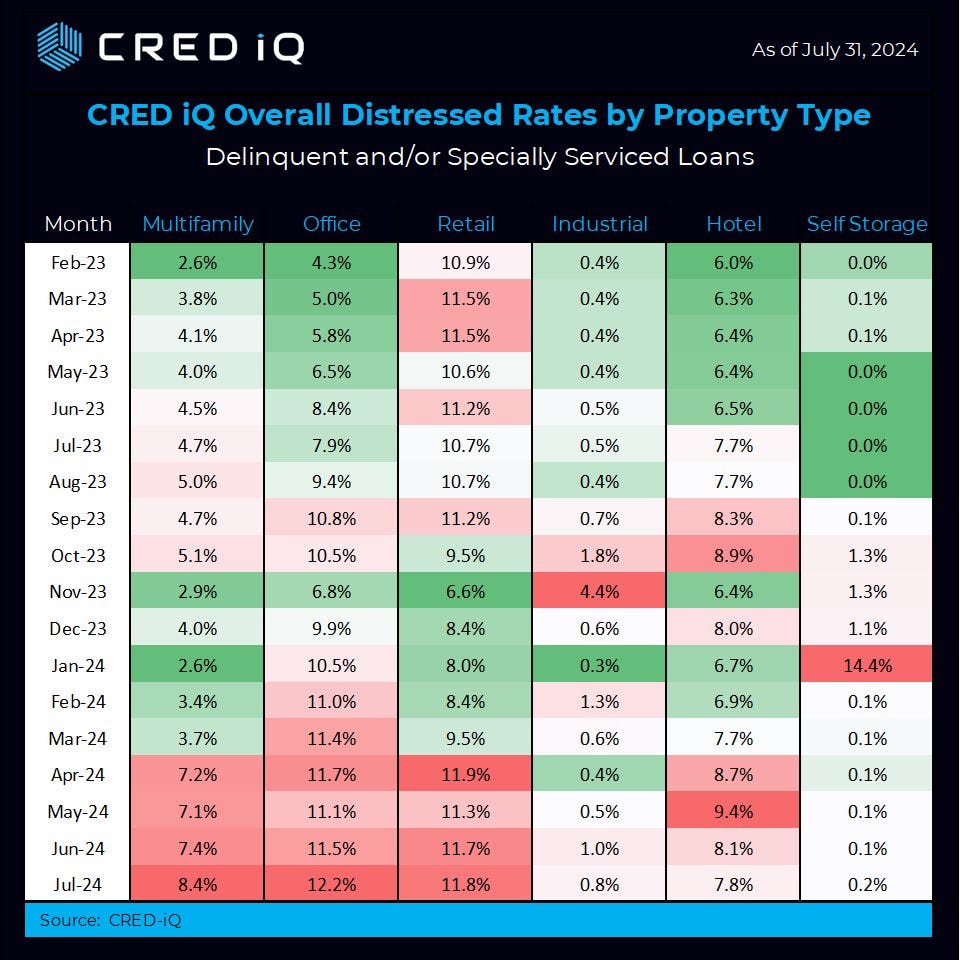

Second, while mortgage loan delinquencies remain subdued (see the above chart), delinquencies for multi-family loans have risen sharply in recent months (see the chart below). This increase suggests that renters in multi-family housing are struggling to pay their rents.

Source: https://cred-iq.com/blog/2024/08/09/multifamily-distress-jumps-100-basis-points-in-july/

Third, Disney, Airbnb, and Hilton, which had exceptionally strong demand in 2022 and 2023, are now seeing weaker demand this summer, which is traditionally a peak season of the year (see below). Coupled with the disappointing Q1 earnings reports from giants like Starbucks and McDonald’s, the financial distress facing the bottom half of the U.S. wealth distribution is undeniable and intensifying.

Source: https://www.ft.com/content/18563f75-e05d-489e-a0f0-639d4babac11

Fear or Greed

How should one position their portfolio heading into the fall? The answer reveals itself unmistakably when you delve into the following three charts. On one hand, stock ownership among U.S. households and non-profits has reached an all-time high (see below).

Source: https://www.visualcapitalist.com/american-stock-ownership-by-share-of-financial-assets/

On the other hand, Warren Buffett has been selling stocks and now holds more T-Bills—$277 billion worth—than the Federal Reserve. Additionally, Berkshire Hathaway’s cash position as a percentage of total assets is at its highest level since 2005. This move underscores Buffett’s timeless wisdom: “Be fearful when others are greedy. Be greedy when others are fearful.” As always, thank you for reading.

Source: https://www.ft.com/content/2aa3b542-d4e4-4afb-8d81-89bb734d7b17

Source: https://www.bloomberg.com/opinion/articles/2024-08-05/warren-buffett-s-277-billion-hoard-after-unloading-apple-is-a-warning?embedded-checkout=true