Greetings. Hope everyone is enjoying the summer. My summer has been great so far, as I am thoroughly enjoying teaching my first investment class at LMU. In my last class, I discussed how the Federal Reserve is very likely to start cutting interest rates in September, even though my view is that they should start cutting by the end of this month. In this journal, I will talk about why I, as well as the market, think the Fed will start rate cuts in September and the implications for the markets.

Shelter CPI Inflation Finally Dropped

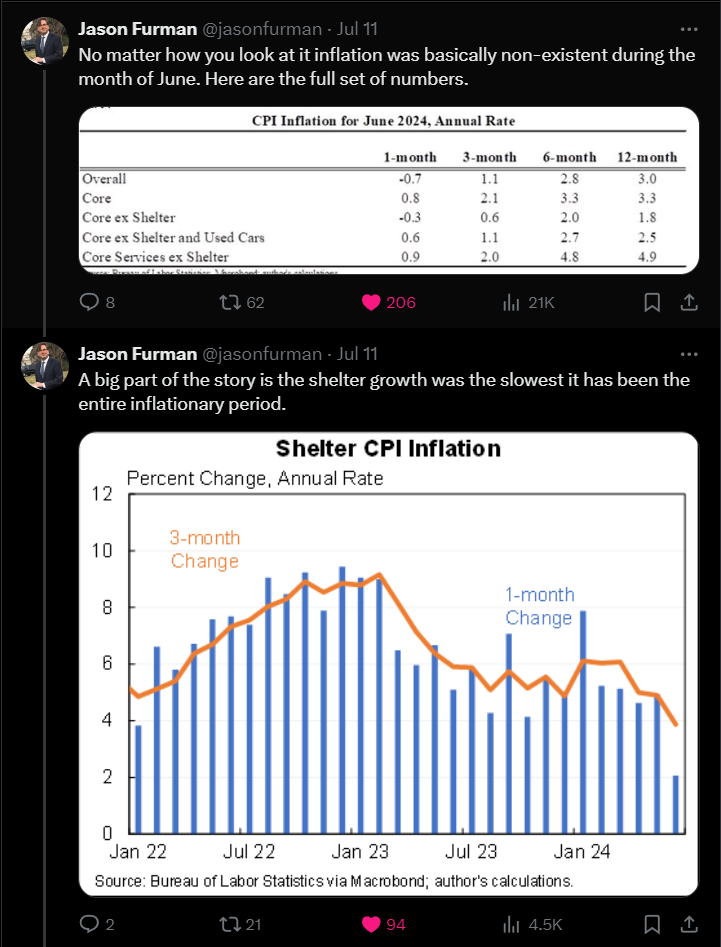

Last October, in journal #6, I expressed my optimism that the inflation problem was behind us, mainly because the government rent data lags the more updated market data such as the Zillow Rent Index, which had fallen back to pre-COVID levels. In the latest inflation data released last week, the government rent data finally caught up with reality, showing only a 2% annualized growth rate instead of the 5+% of the recent past (see the Shelter CPI chart below). In addition, as Prof. Furman of Harvard pointed out in his posts on X, other inflation data (i.e., core ex-shelter) was essentially non-existent in the June report (see the top table below), which would give the Fed the green light to cut.

Source: https://x.com/jasonfurman/status/1811379693251149975

Weak Economic Activities

While the inflation data opens the door for the Fed to cut rates, recent economic data is screaming at the Fed to do so, as data released in Q2 has been very weak. As shown below, the Citi US Economic Surprise Index has moved from approximately +50 to -50 in a quarter. This index tracks all US economic releases and evaluates whether the actual economic releases have outperformed or underperformed market expectations. If the actual data outperforms, the index is positive. If not, it’s negative. At -50, most economic data releases in Q2 have surprised the market on the downside.

Source: bloomberg

In my last journal, I described the US economy as being glass half full. Perhaps I was too optimistic. The latest bankruptcy data released by S&P (below) shows that corporate bankruptcies in the first half of this year have surpassed the 2020 level. Additionally, it has reached the highest level since 2010, providing the Fed with more reasons to start cutting rates.

Source: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/us-corporate-bankruptcies-in-june-reach-highest-monthly-level-since-early-2020-82297569

Labor Market Trend Continues to Worsen

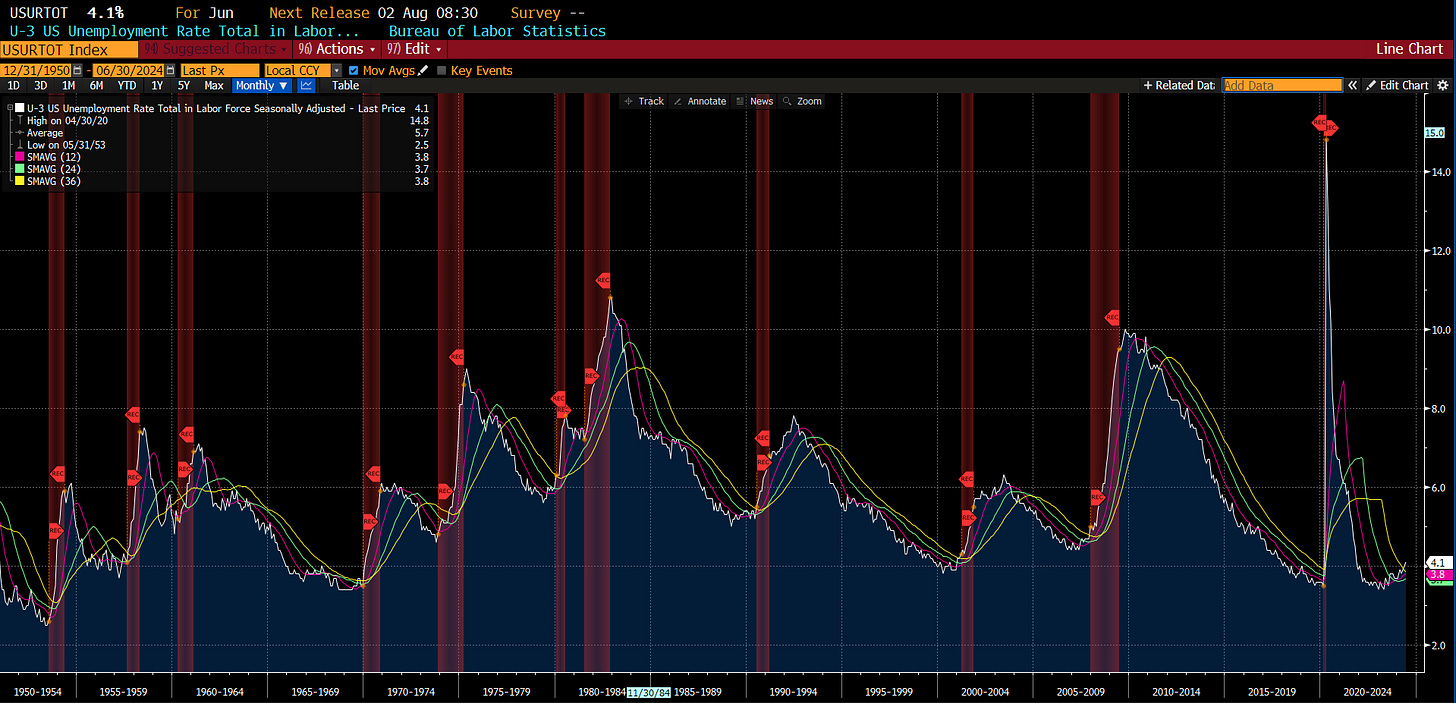

As mentioned in my last month's journal, the 3-month average of the unemployment rate is a key measure I follow to determine the risk of a recession. Historically, once this level is breached, the unemployment rate tends to keep accelerating until the recession ends. Unfortunately, the latest June number increased by another 0.1% to 4.1%, further rising above its 3-month average of 3.8%.

Source: bloomberg

Moreover, looking at the latest small business surveys on employment changes and job openings (below), I think it is highly likely that the weak labor market trend will continue to deteriorate. This is why I believe the Fed should cut rates now, instead of waiting until September.

Source: the Daily Shot

Implications for Bond and Stock Investors

For US bond investors, the implications of the beginning of Fed rate cuts are straightforward: your patience will be rewarded. By how much? It’s too early to tell, as the extent of the rate cuts will depend on whether a recession scenario plays out and how mild or severe the recession will be. Even in a soft-landing scenario, we could see 3-4 cuts (just a guess, based on the number of rate cuts during the 1995 soft-landing scenario).

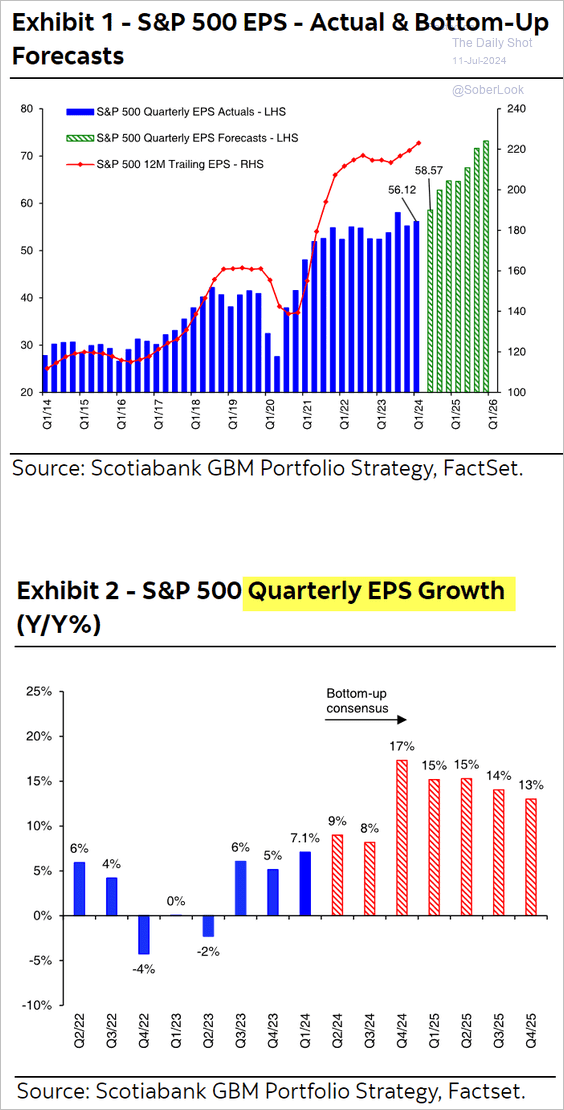

For US equity investors, the implications are more complex. A soft landing would be the most optimistic scenario, but even in this case, achieving actual earnings results that meet lofty expectations is a tall order, especially for the period after Q4 2024 (see below).

On the other hand, if the recession scenario plays out, not only the double-digit growth expectations would not be realized, the S&P earnings are likely to have negative double-dight declines instead. Moreover, the current forward P/E of 21X is likely to debase to 16X, which is just the long-term average; the 2008 lows were much lower at 10X P/E.

Source: https://yardeni.com/charts/yri-earnings-outlook/

This is why historically the beginning of rate cuts has not been friendly to S&P 500 investors. As shown in the chart below, the S&P 500 has recorded an average decline of 23.5% over a period of 195 days from the first Fed cut to the market low. Given the current bullish sentiment surrounding the equity markets, this could be a rude awakening.

Source: https://x.com/Barchart/status/1812333752191778942

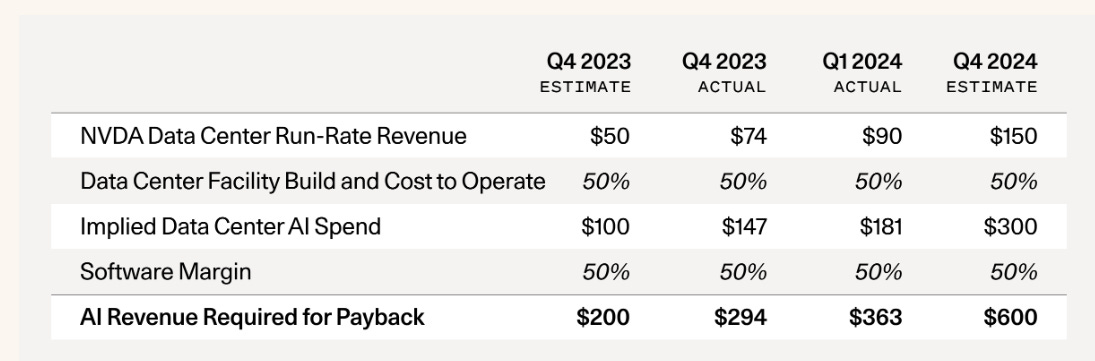

To end this journal, I would like to mention another potential rude awakening. Amid the AI hype, Sequoia Capital, one of the best VC firms in the US, is questioning where the AI revenues required to pay back all the GPU investments will come from. Based on Sequoia's analysis, $600 billion in revenues are needed (see below), and Sequoia was able to come up with $125 billion of revenues generously; hence, there is still a $500 billion hole. As Warren Buffett famously said, “only when the tide goes out do you learn who has been swimming naked.” I think we will find out who the naked swimmers are soon. As always, thanks for reading.

Source: https://www.sequoiacap.com/article/ais-600b-question/