Greetings. Two months ago, I delved into the issue of poor consumer confidence in China, underscoring how this lack of optimism presents a significant risk to the nation's economy, overshadowing concerns about demographics, debt, or deflation. Recently, Xi unveiled a series of economic policies aimed at bolstering consumption, prompting the question: Has Xi become more market-friendly like Deng? In this journal, I will examine these policies and attempt to answer this question.

“Patience is Bitter, but Its Fruit is Sweet”

Just as I was starting to lose patience with Beijing's lack of growth stimulus (cutting rates isn't a growth stimulus when people are busy paying back loans), Xi pulled three rabbits out of his hat (or crown as he is the emperor for life) and surprised the markets. These three rabbits are:

1) The Trade-in Equipment Stimulus Program

2) Hinting that the Bank of China should increase trading of treasury bonds

3) Purchasing unsold apartment units for public housing

Trade-in Equipment Stimulus Program

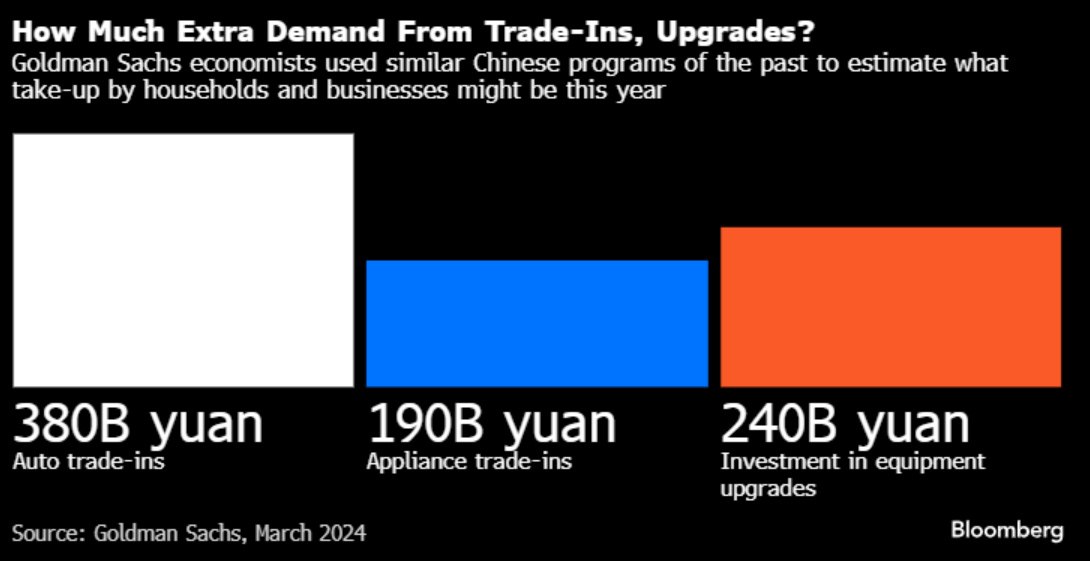

This is the closest thing to a western-style consumption stimulus program. What the government has pledged is to utilize central government funds to subsidize upgrades on old equipment, appliances, and autos for both consumers and businesses, with the aim of boosting spending by at least 25% by 2027 compared to last year. Although the government didn’t specify the exact amount of government funding for the program, Goldman Sachs estimated that the plan could induce 800 billion yuan of spending or 0.6% of GDP (see below).

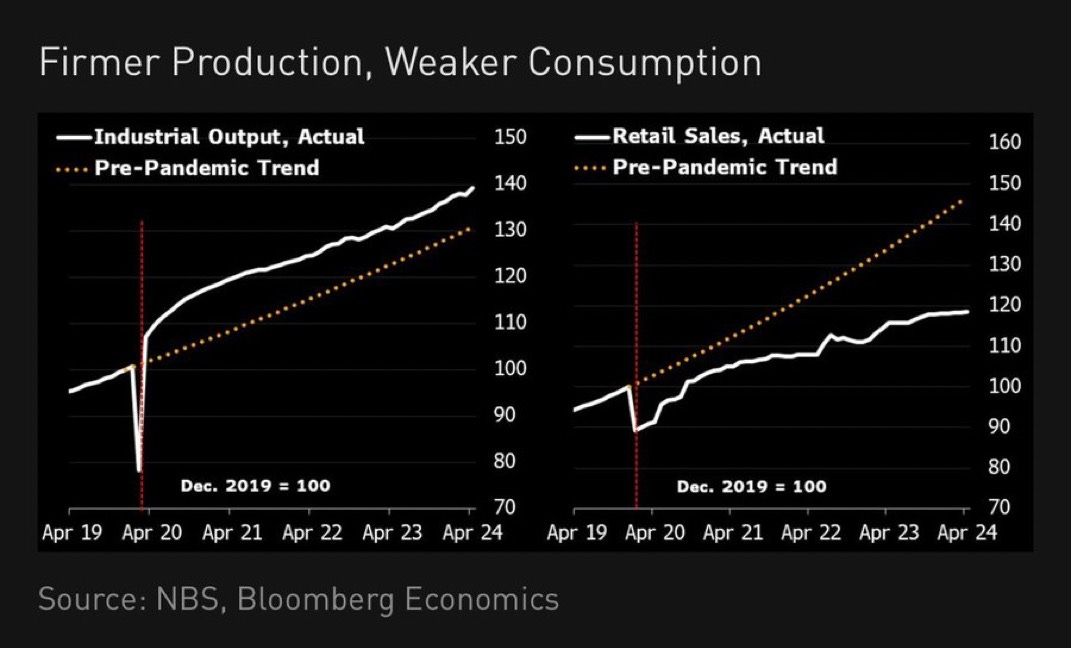

Although I would have leaned towards implementing a more direct consumption coupon program, as discussed in Journal #9, it appears that this initiative is geared towards ensuring the ongoing prosperity of China's industrial powerhouse. Nevertheless, as the saying goes, "beggars can't be choosers." I embrace any effort that encourages individuals to utilize their substantial savings in the bank to spend, especially considering the current weakness in retail sales in China (see below).

Hinting of QE

Weeks after a rather peculiar article from the South China Morning Post quoted a speech by Xi late last year, stating, “It is necessary to enrich the monetary policy toolbox; the People’s Bank of China must gradually increase the trading of treasury bonds in its open market operations,” the PBOC announced that buying and selling treasury bonds in the secondary market could be used as a monetary policy tool. Instructing the central bank to buy more treasury bonds is a rare and unexpected move from Xi, given his well-known style of not giving specific direction, especially considering the PBOC's lack of bond trading activity since 2007. Nevertheless, this adoption of a western-style quantitative easing (QE) approach is very welcome, as it should prove far more effective in stimulating the economy than merely cutting rates alone.

Just this week, the Ministry of Finance announced that it will start selling 1 trillion of ultra-long bonds to boost its economy. While we don’t know if the PBOC will buy any of these bonds in the secondary markets, the fact that the government is taking such proactive measures suggests a concerted effort to ensure it can reach its 5+% economic growth target.

Buying Up Unsold Apartments

Lastly, in a move that may show Xi has become more market-friendly, China announced last week that the central government will provide 1 trillion yuan in cheap loans to assist local governments and state-owned enterprises in purchasing unsold apartment units and converting them into public housing. Additionally, it announced further relaxation of mortgage rules, reducing the minimum down payment ratio for first-time homebuyers to no less than 15% and for second-home buyers to no less than 25%—the lowest minimum down payment ratio in recent Chinese history.

As a socialist country, China does not rank high in providing social protection, according to a study by the IMF (see below). This is one of the key reasons why the savings rate in China is the highest among major countries.

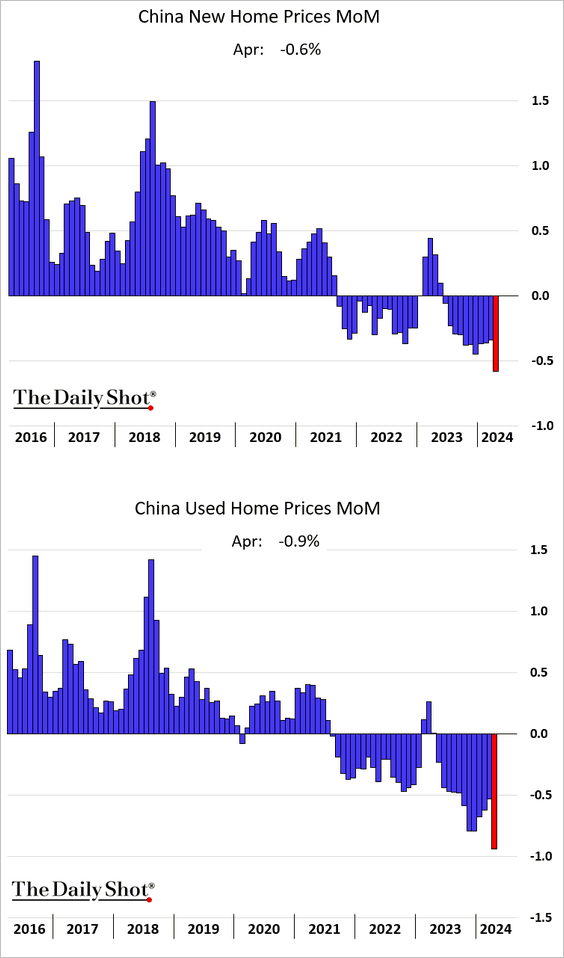

Therefore, this "historic" initiative of purchasing unsold apartments and converting them into public housing is indeed commendable. Not only will it alleviate the current downward pressure on home prices in China (see below), but it will also serve a social purpose by potentially reducing China's saving rates in the longer term, thereby guiding the country towards a more consumption-based economy. My only hope is that the government would allocate 3-5 trillion yuan instead of 1 trillion, considering Goldman Sachs' estimate that the saleable housing inventory was around 13.5 trillion yuan by the end of last year. Nevertheless, at this point, I shouldn't be greedy.

The Fruit is Quite Sweet

As Aristotle once said, "Patience is bitter, but its fruit is sweet." The fruit of being a patient investor in China has indeed been quite sweet. Year-to-date, the MSCI China has outperformed the S&P 500 by almost 5%, and KWEB (China Internet ETF) nearly doubled the year-to-date return of QQQ (Nasdaq ETF). Clearly, the China/HK markets still significantly underperformed the US markets on a three-year basis. The question remains whether these rallies in the China markets can continue.

More Fruits to Come?

In my opinion, the likelihood of this rally continuing is quite high for the following reasons:

1) After the year-to-date rally, the China markets still appear undervalued; both the P/E and P/B ratios of the MSCI China index are at the low end of the range seen over the past 10 years (see below).

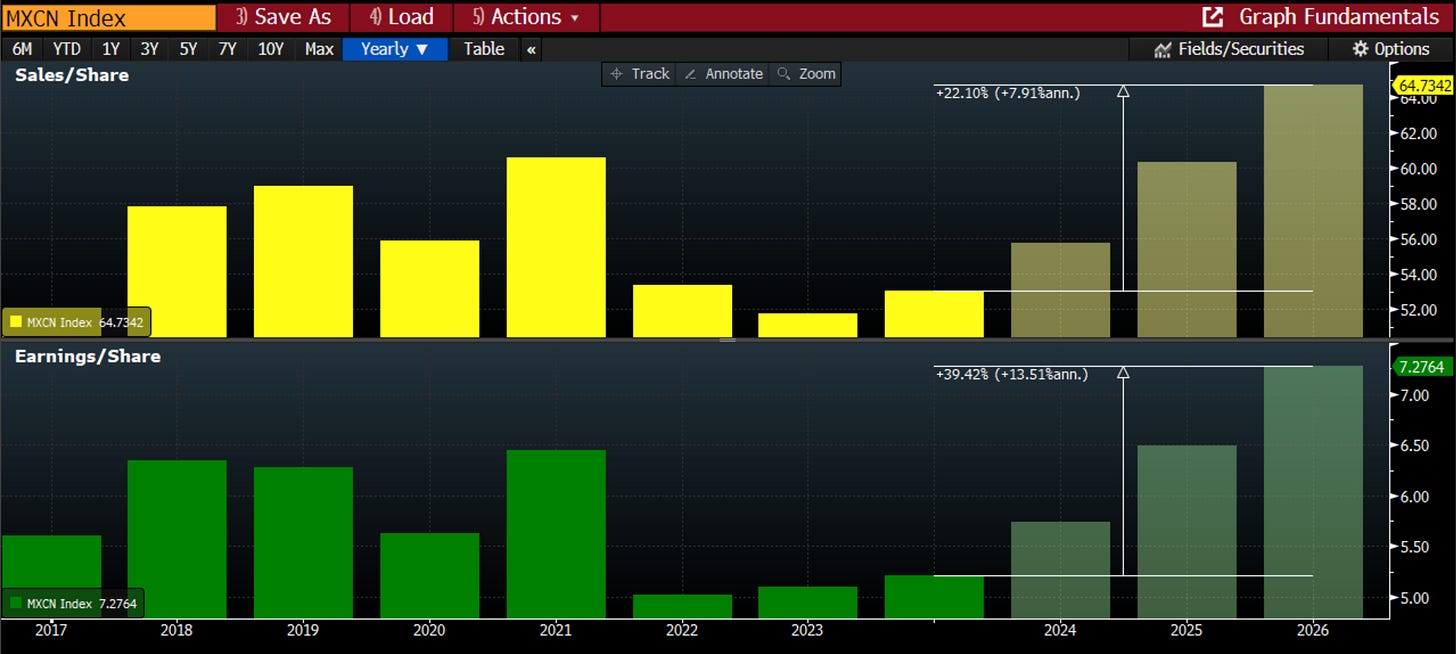

Furthermore, if the sales per share and the EPS of the MSCI China index can come anywhere close to the current consensus estimate levels in the next 3 years shown below, not only we may benefit from earnings growth but also potentially from multiple expansion.

2) Despite the year-to-date rally, foreign investor participation in the China market remains lacking. According to the latest Bank of America Fund Manager survey below, shorting China is still one of the most crowded trades, alongside long Mag 7, long Japan equities, and long bitcoin.

Nonetheless, we've started to notice a few significant investors diving into the Chinese market. David Tepper, renowned for his stellar track record at Appaloosa, recently revealed a hefty 23% allocation to Chinese equities. Even Michael Burry, the real-life inspiration behind the character portrayed by Christian Bale in "The Big Short," (whose track record is more mixed), has doubled down on China in Q1. With China equities showing strong year-to-date performance and these big-name investors making substantial moves in the market, momentum money is poised to follow suit.

3) Most importantly, if Xi's three-pronged approach manages to boost consumer confidence and consequently stimulate even a fraction of household deposits into the economy, we might just be witnessing the beginning of several years of Chinese equity recovery. In other words, with household deposits currently equaling the size of the economy in China (see below), if households collectively spend their interest income (roughly 2%), the Chinese economy could see a 2% incremental growth from consumption alone, without even factoring in the multiplier effect.

Has Xi Become More Market Friendly?

I'd like to conclude this journal by revisiting the question of whether Xi Jinping has become more market-friendly. In my assessment, the answer is both yes and no. As eloquently stated by Professor John Mearsheimer, one of the foremost political science scholars globally, power in international politics is a combination of population size and wealth. With Xi, along with his BFF Putin, aiming to lead the global south in challenging the west, it's imperative for China's economic engine to maintain full throttle. So being market-friendly is simply a necessity for him to ensure China's wealth and maintain power and influence in the global south.

However, this geopolitics also poses the greatest risk for any investors in Chinese equity. The 100% tariffs imposed by Biden on Chinese-made cars serve as yet another reminder of this risk, and BFF Putin's visit to China and their joint statement afterward certainly made many foreign investors uncomfortable. This is the new reality in a multipolar world for global investors. As always, thank you for reading.