Greetings! I recently watched in the movie "Ferrari," featuring Adam Driver, and found it captivating. While the film delves into Enzo Ferrari's intricate personal life, his unyielding devotion to racing resonates in every scene, particularly during the legendary Le Mans race.

The iconic 24 Hours of Le Mans presents the ultimate test of endurance, where the final hour demands both physical and mechanical resilience. After 23 hours of relentless racing, drivers confront exhaustion and mental strain as they push their sleek racecars with their alluring curves and supercharged engines to the brink. The last hour becomes a grueling trial of both human and machine, where precision and tenacity reign supreme.

Today, I draw parallels between the final stretch of the Le Mans race and Jerome Powell's ongoing battle against inflation. Over the past 24 months, amidst escalating inflationary pressures, Powell, akin to a seasoned racecar driver, finds himself in the homestretch of this arduous race, with his 2% inflation goal almost within reach. However, as any racer knows, the last miles are invariably the most challenging. In this journal entry, I delve into our current position in the fight against inflation, the state of the US economy, and the implications for both the stock and bond markets.

The Last Mile is Always the Toughest

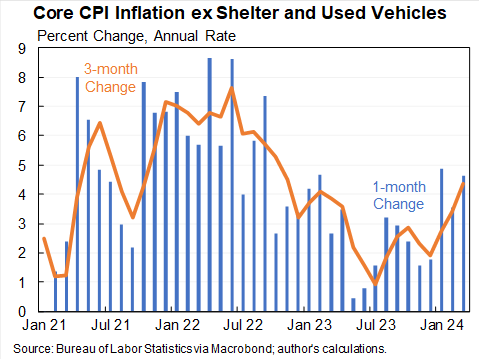

Following a notable decline throughout much of 2023, core inflation has reversed its trajectory in the first quarter of 2024, surging above the 4% mark in the three-month trend line, as depicted in the chart below provided by Prof. Furman at Harvard in his X note.

The primary drivers behind this reversal in trend are twofold:

The shelter component of core CPI, which constitutes approximately 40% of the index, has seen an increase over the past three months. Rather than following a downward trend towards the more updated rent data, such as the Redfin Rent Index at +0.8%, the official Shelter CPI inflation surged by +6%.

The Supercore CPI index, favored by Powell and an alternative CPI measure excluding foods, energy, shelter, and used cars (often humorously referred to as the "CPI for the homeless"), has witnessed a notable uptick in the past three months. Consequently, Powell's final push towards the 2% inflation target has proven to be exceptionally challenging.

The State of the US Economy: Encouraging Signs Abound

Thus far, the US economy appears stronger than anticipated by most economists. The labor market, in particular, has shown resilience in recent months. After dipping below 200K in October and November of last year, non-farm payroll figures have rebounded to the upper range of 200K in the past four months, as depicted below.

Similarly, retail sales have experienced a resurgence over the past two months following tepid numbers in late 2023. Lastly, the Leading Economic Indicator, which had remained negative for the past two years, finally turned positive last month, signaling a promising shift in economic trajectory (see below).

But Let's Not Get Ahead of Ourselves

However, before we break out the champagne, it's important to take a step back and examine the nuances of the current economic landscape. Despite some positive indicators, the underlying strength of the US economy may not be as solid as it appears at first glance.

Firstly, while there has been growth in employment figures, a closer look reveals that much of this growth has been in part-time positions, masking a concerning trend of full-time job losses. Given that part-time jobs typically offer lower wages and less stability, the recent increase in their numbers may not be as encouraging as it initially seems.

Moreover, delving deeper into the data unveils that the surge in part-time employment has been largely confined to just three sectors: Government, Healthcare, and Leisure/Travel. Outside of these sectors, there has been little to no growth in job opportunities, raising questions about the broader health of the economy.

Can the Economy Thrive with Only the Top 50%?

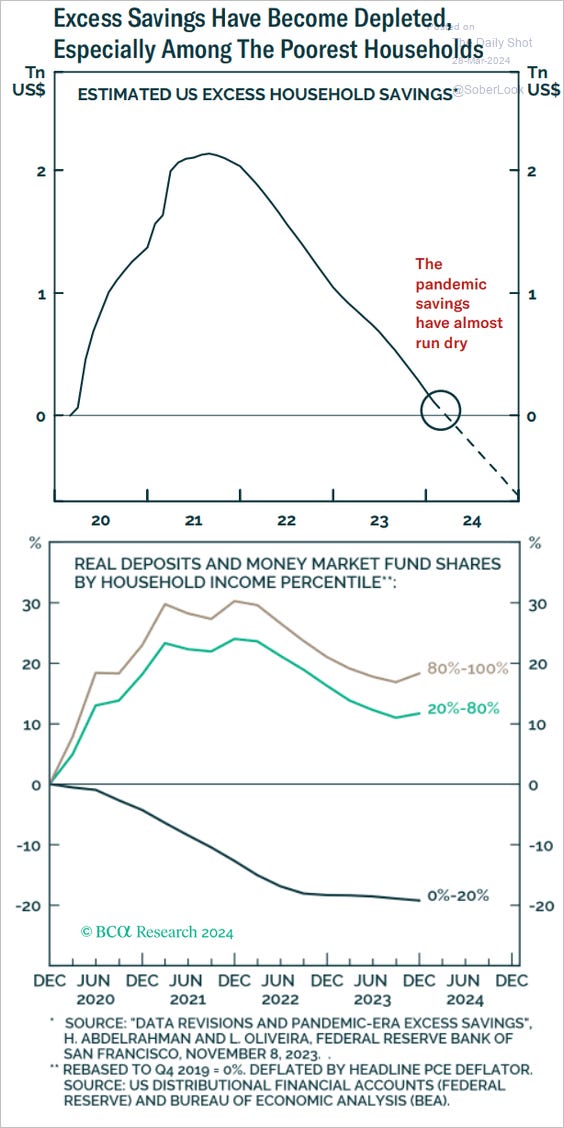

Examining both the data below and Jamie Dimon's recent remarks during his earnings call, it becomes apparent that the excess savings of the bottom 50% have largely dissipated. This, coupled with the significant shift where non-mortgage interest expenses for US households have surpassed mortgage interest expenses for the first time, explains Dimon's cautious tone despite the otherwise positive economic indicators. In addition, what spoke louder than his words was the fact that, for the first time since he joined JP Morgan twenty years ago, Jamie sold $180 million worth of his JP Morgan shares in the past two months.

Therefore, it makes you wonder about whether or not the economy can keep chugging along if only the top 50% are spending. Sure, the bottom 50% might still be swiping their credit cards and jumping on buy-now-pay-later deals. But as Warren Buffett cleverly put it, "interest rates are to debt as gravity is to apples." A hefty 22% annual credit card rate is a powerful gravitational force, eventually leading to a financial crash landing.

Implications for Bondholders and Stockholders

The sobering reality for bondholders is that Powell is unlikely to entertain rate cuts in light of these robust CPI figures. Even if there's a softening in CPI data over the next few months, I anticipate Powell will exercise caution, prioritizing the attainment of his 2% inflation goal in his economic "Le Mans" race. However, there's a caveat: should the job market falter down the line, with the unemployment rate trending upwards and surpassing the critical 4% threshold, Powell may find himself compelled to initiate rate cuts. Why 4%? Because that aligns with the Federal Reserve's own economic projection target for 2024.

Historically, the NFIB small business hiring plans survey has served as a reliable leading indicator of the broader job market outlook. Given the recent survey's indication of a significant downturn in hiring intentions, I would recommend that bondholders remain patient for the time being.

Whether Powell refrains from cutting rates due to robust CPI data or decides to cut rates due to weak employment figures, neither scenario appears favorable for stockholders, particularly given the current concentration within the equity market and its stretched valuation (as evidenced below). Therefore, my advice is to exercise caution, mirroring Jamie's prudent approach, and proceed with care. Unlike Ferrari's imperative to win the Le Mans race, your objective is to sustain your journey, enjoy the ride, and avoid crashing your sleek, curvy racecar. As always, thanks for reading.