Journal #11: Debt and Deflation Were Not the Real Problems for China; It's the Lack of Hope...

March 2024

After spending two and a half weeks in Hong Kong, I am finally back in Los Angeles. During my visit, I had the pleasure of reconnecting with old friends, former colleagues, and clients. Our conversations spanned a wide range of topics, from geopolitics to the recent China stock rout and the ongoing AI craze. In this journal entry, I will delve into the remaining two of the three Ds of China—deflation and debt—and conclude with my key takeaways from the trip. (Demographics, the other D, was discussed in Journal#10)

Deflation or Just Normalizing Pork Prices?

One of my investment heroes is Howard Marks; his memos over the years are essential reading for anyone striving to excel in investing. A fundamental lesson from Marks is the importance of second-level thinking. He eloquently describes how "first-level thinkers see what’s on the surface, react to it simplistically…" while "second-level thinkers double-think (and triple-think) every angle of every situation." For further insight into second-level thinking, I recommend reading his 2015 memo: https://www.oaktreecapital.com/docs/default-source/memos/2015-09-09-its-not-easy.pdf.

Unfortunately, much of economic journalism these days tends to reflect first-level thinking, as second-level thinking is considered too "deep, complex, and convoluted" to garner the attention-grabbing headlines that attract readership or clicks. Consequently, last year, the prevailing narrative surrounding China depicted it as experiencing deflation while the West grappled with inflation. But was this truly the case?

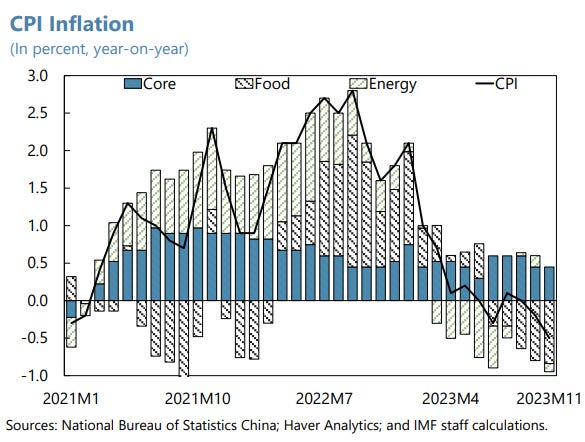

On the surface (first-level thinking), China did indeed exhibit negative CPI, as indicated in the chart below. However, upon delving beyond the surface (as illustrated in the chart below), one discovers that:

1) Core CPI, a more reliable gauge of inflation that excludes food and energy prices, remained relatively stable and positive.

2) Food prices served as the primary driver of the negative CPI.

Moreover, a deeper examination reveals that pork constitutes a significant component within the food category of CPI, and pork prices have undergone substantial fluctuations in recent years, ranging from nearly 100% increases in prices in 2022 to nearly 50% decreases in prices in 2023.

While I lack insight into the future trajectory of China's pork prices, it's worth noting that lower food prices aren't necessarily a significant economic concern for China—or any country, for that matter. Here in the US, if food prices were to revert back

o pre-COVID levels, it's unlikely that the media, politicians, or voters would perceive it as a deflationary disaster. Instead, most would likely welcome and celebrate the prospect of lower food prices.

More significantly, given the current weak aggregate demand observed in China, a low core inflation rate could potentially empower the central bank to implement more aggressive monetary expansion measures to stimulate aggregate demand. Therefore, instead of viewing negative CPI as a detriment to China, I see it as an opportunity to utilize aggressive monetary policy tools, such as money printing, to enhance economic activity, should the central bank choose to do so. Unfortunately, the People's Bank of China has yet to seize this opportunity, a topic I will discuss later on.

Which government does not have debt fueled growth?

One frequent criticism of China's economic miracle in the past is that it has been fueled by debt-driven growth, which many argue is unsustainable in the long run. While these assertions hold a degree of truth, it's important to recognize that China is not unique in utilizing debt to propel its economic expansion. A recent Forbes article examining US debt growth highlights that the phenomenon of leveraging debt for economic growth is not exclusive to China; it's also a cornerstone of US economic policy.

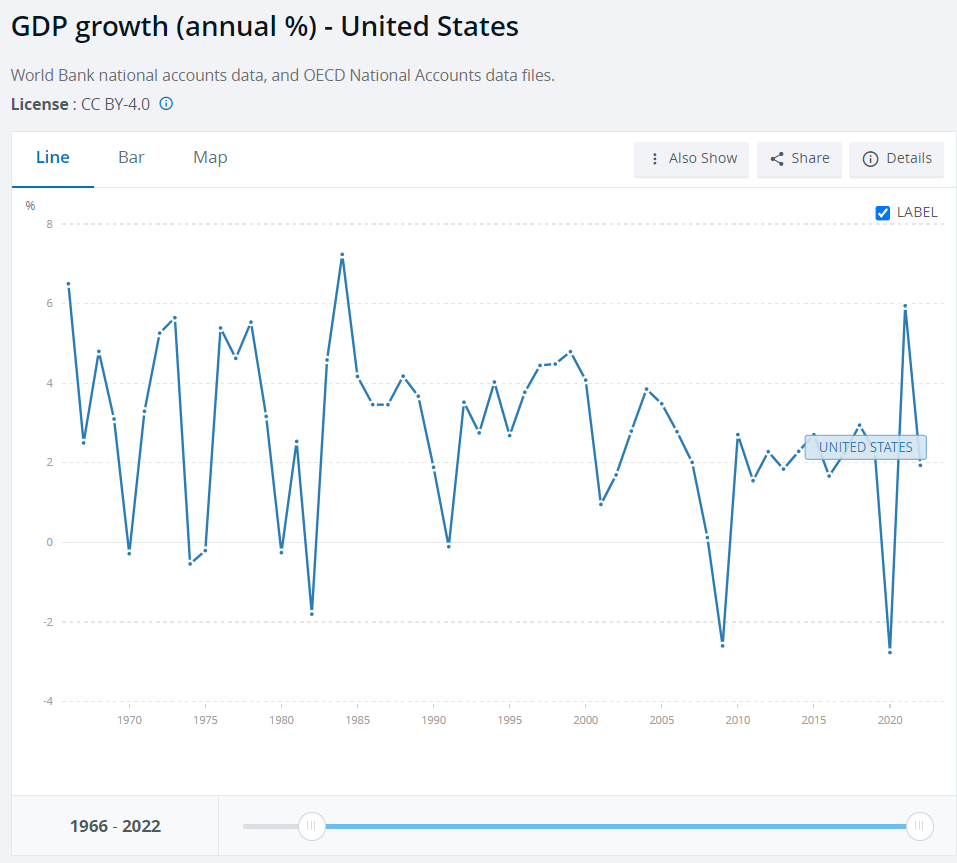

As depicted in the chart below, the average annual increase in US federal debt stood at 8.4% between 1966 and 2023. Over the same period, real GDP growth in the US hovered around 3% (to be precise, 2.8%, but let's round up for generosity). Consequently, nominal GDP growth in the US—calculated as the sum of real GDP growth and CPI—averaged 7% between 1966 and 2023, trailing behind the growth rate of federal debt at 8.4%. Therefore, the strategy adopted by China, which relies on debt-fueled growth, mirrors the playbook that the US has been employing for the past 58 years.

Source: worldbank

Who has the cleanest dirty shirt?

In the realm of debt-fueled economies, not a single country has a clean shirt. While China may not have the cleanest dirty shirt in terms of its debt level, it hardly boasts the dirtiest shirt. Japan, as shown below, currently holds the record for the highest debt-to-GDP ratio in the world, with over 400% total debt to GDP (far surpassing China). Furthermore, Japan has been running a budget deficit of over 6% for years (see chart). For the experts who keep insisting that China's debt growth is unsustainable, I wonder what they think about Japan's debt growth and its budget deficit.

Despite China's total debt-to-GDP ratio being similar to that of the US (300% vs. 280%), I would argue that China still has room to increase its debt to fuel economic growth. This assertion is supported by its comparatively low interest expense as a percentage of revenue (tax collection), especially when contrasted with the US, as depicted in the chart below.

Note: The chart below displays interest payments as a percentage of revenue, encompassing only central government debt and excluding local government debt. Even if we hypothetically assume that the central government in China absorbs all local government debt, effectively doubling the level of central government debt, the interest payment as a percentage of revenue would likely rise from 4% to 8%. Nonetheless, this figure remains notably lower than that of the US, which stands at 14%.

Source: IMF

Furthermore, it's ironic that China, as a socialist country, still lacks estate tax, capital gains tax, and real estate tax. Therefore, China has ample room to increase its tax revenue and expand its debt level.

In my opinion, contrary to what the media portrays about China's supposed inability to utilize debt for future economic growth, I would argue otherwise. Just as the US has recently increased its federal debt by USD$1 trillion in the past three months alone (from USD$33 trillion to $34 trillion), the People's Bank of China (PBOC) has yet to fully leverage another policy tool to stimulate its weak aggregate demand.

Interestingly, as I was writing at this moment, news broke that Xi instructed China's central bank to resume bond buying (similar to US-style money printing). [https://www.scmp.com/economy/china-economy/article/3256967/xi-jinping-chinas-central-bank-restart-treasury-bond-trade-after-2-decade-hiatus]. Let's see if the PBOC follows through with a meaningful amount of money printing. In my view, what would be meaningful? USD$2 trillion money printing in a $18 trillion economy.

Lemons to Lemonade

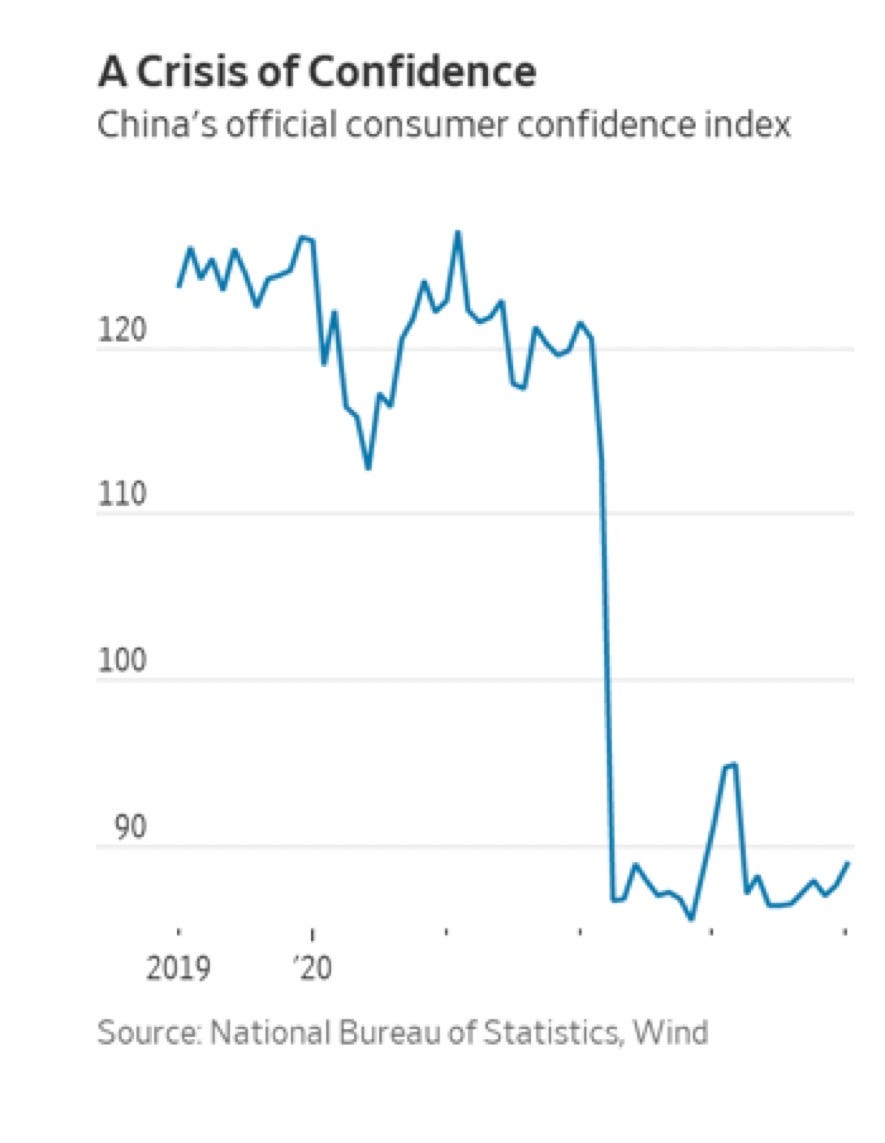

What some perceive as the three lemons for China (demographics, deflation, and debt), I see as opportunities to make lemonade. However, it is up to the leadership in China to turn lemons into lemonade. Unfortunately, thus far, its recent track record has not been impressive, leading to a decline in consumer and business sentiment, as evident from the charts below. This is also my main takeaway from my trip speaking with many individuals living, working, and conducting business in China.

The Force of 1.4 billion people

I would like to conclude this journal by citing a recent article by Martin Wolf, the chief economic commentator at Financial Times, addressing a question that is on everyone’s mind: “whether Xi-ism is killing Deng-ism”. Here is the link to the full article, which I encourage all of you to read: (https://www.ft.com/content/58bb9713-2d71-4a50-b825-f7213907491b).

Below is Martin’s conclusion. I hope he is correct; however, I have my doubts, but I am happy to be proven wrong. As always, thank you for reading. Happy Easter!