Greetings everyone, and I hope you all had a wonderful Chinese New Year celebration. I am thrilled to share some exciting news: I have recently joined the part-time faculty at Loyola Marymount University. Starting this summer, I will be teaching a new investment course titled "Portfolio Strategies and Management." Additionally, I am honored to serve as a faculty advisor to the Lion Cub Fund, a student-led fund focused on investments in public companies. Throughout my career, I have been fortunate to learn from many esteemed mentors who graciously shared their insights, wisdom, and time. Now, I am delighted to have the opportunity to pass on the knowledge and mentor the next generation of portfolio managers and analysts.

I want to extend my gratitude for the feedback I received from one of the readers regarding my last journal entry. Based on that feedback, in this and next journals, I will share my views onto China's three structural issues, which have been widely discussed in the media over the past year. I refer to these issues as the "3 ugly Ds of China" - Debt, Deflation, and Demographics. Among these challenges, demographics stands out as the most pressing and serious, so I will address it in this journal entry first.

Falling Birth Rate and Rising Death Rate

The falling birth rate in China didn’t begin because of Covid; in fact, it started to drop after China ended the one-child policy, which was quite ironic (the same as the birth rate increased at the beginning of the one-child policy. See chart above). The reasons for falling birth rates are similar to the trends that Western countries experienced in the past decade: more people staying single and the size of the family getting smaller, especially for those who live in metropolitan cities. Below are a set of charts showing how these trends emerged between 2010 and 2020 in China.

Source: EIU

Combined with a rising death rate (see below), China has experienced two consecutive years of population decline, mirroring the trend observed in Japan and Europe in recent years.

Latest Population Projection from EIU

According to EIU, the sister company of The Economist, which is arguably one of the fiercest critics of China, China's population is projected to fall below 1.39 billion by 2035 from 1.41 billion in 2023 (source: https://www.eiu.com/n/chinas-demographic-outlook-and-implications-for-2035/#:~:text=EIU%20has%20updated%20its%20demographic,deaths%20from%20an%20ageing%20population).

While its latest projection shows a larger population shrinkage than its previous forecast, we are still discussing a relatively small decline of approximately 20 million people out of 1.41 billion, or 1.41%, over the next 12 years, and that China will continue to maintain its position as the world’s second-largest population.

However, due to its aging population, a more significant concern for China over the next 12 years is the decline in the working-age population. Based on the same EIU projection, the working population is expected to decrease by 57 million (~6% in 12 years), dropping from 965 million to 908 million, surpassing its overall population decline. Critics point out that with a declining workforce, economic growth will suffer, and China's position as the world’s largest manufacturing powerhouse will be challenged (see chart below).

Some experts advocate for China to raise the official retirement age, currently set at 60 for men and 50–55 for women. While this adjustment should work and might delay the onset of the demographic issue, it will not fully alleviate it. In my opinion, the key factor lies in labor productivity growth.

In what economists refer to as an aggregate production function, GDP growth is determined by three inputs: the labor force, physical capital (tangible assets like equipment, plants, etc.), and labor productivity. While the size of the labor force is undoubtedly crucial, advancements in labor productivity are equally significant.

Can Robots Save the Day?

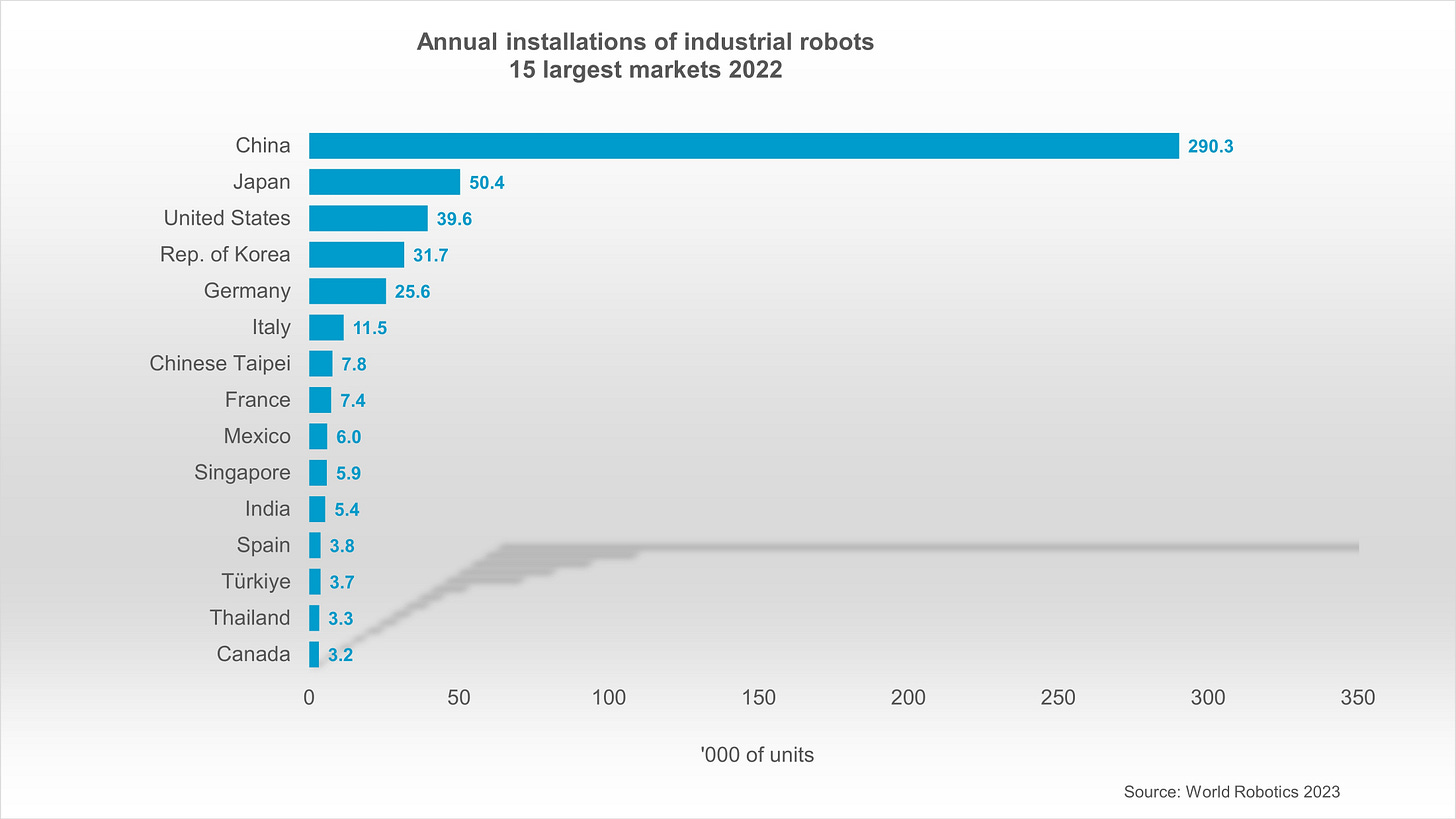

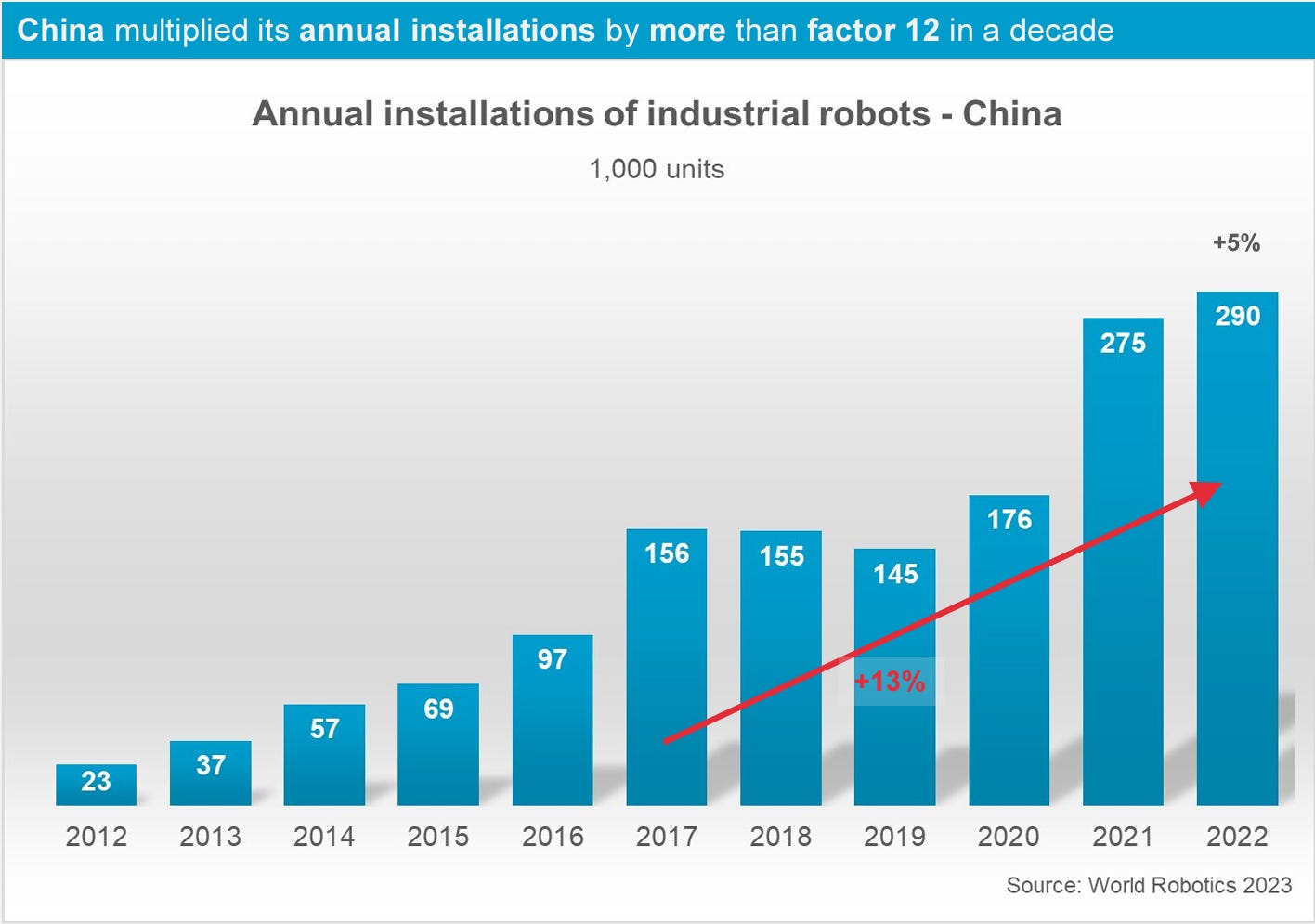

According to the World Robotics Report 2023, China has been the largest installer of industrial robots for many years (see below), accounting for over 50% of total world installations.

Combining these statistics above with two research studies* (one from MIT and the other from the National Bureau of Economic Research), which concluded that each industrial robot could replace 3.3 to 5.6 workers (let's use the average of 4.5 workers per robot), China's installation of 290,000 industrial robots in 2022 is equivalent to an additional 1.3 million workers (4.5 x 290K).

*Source:

https://news.mit.edu/2020/how-many-jobs-robots-replace-0504

https://www.nber.org/digest/may17/robots-and-jobs-us-labor-market

Therefore, in my view, one strategy for China to address the impact of declining labor force is by expanding the deployment of industrial robots. Considering that the cost of each industrial robot is not excessively high (ranging from US$28K to US$400K) and is likely to decrease over time, it is entirely feasible for China to double or even triple its robot installation base in the next 5 years, as it has previously achieved. While the enhancement in productivity through robotics may not entirely offset the negative effects of a shrinking working population, it is poised to significantly mitigate a substantial portion of its adverse consequences.

Thus far, the increased adoption of robots has yielded notable advancements in labor productivity growth, as measured by GDP per hour worked, in China, surpassing most, if not all, countries in the past decade (see below below).

Source: The Conference Board

Furthermore, while our discussion has mainly focused on industrial robots, there is an entirely new category of service robots that is in its infancy stage. Many of you may have visited Haidilao and have seen firsthand how its robots move around the restaurant, serving customers. If you haven't had the chance yet, I encourage you to experience it for yourself by visiting Haidilao (see picture).

Finally, if JP Morgan CEO Jamie Dimon predicts a 3.5-day workweek for the next generation of workers, thanks to AI and robots (source: https://fortune.com/2023/10/03/jamie-dimon-jpmorgan-chase-ceo-ai-impact-working-week/), I am not concerned about the demographic situation in China, as the benefits of AI and robots transcend national borders.

However, as a reminder and as discussed in Journal #7, given the magnitude of China's $18+ trillion economy, it is natural for its economic growth rate to decelerate to a low single-digit level in the foreseeable future, which remains more than sufficient (see below). As always, thank you for reading and I welcome any feedback and questions.