After almost 30 years of corporate life in asset management, private equity, and wealth management, this week officially marks the first week I no longer have an employer. I am excited to focus on the two things that I am passionate about: investing and golfing.

I treasure the trust and the partnership you have placed in me and my team over the past 13 years when I worked for my former employer. Building an asset management business from a team of one to a team of 26, with over US$10 billion in assets under management (AUM) at its peak, was undoubtedly a highlight of my career. Since I have no intention of joining another bank or setting up my own shop, my reason for writing this journal is to maintain our relationship and hopefully deepen our friendship (more on this later). More importantly, I welcome your questions and challenges regarding my views, as they will keep me honest and rational. Undoubtedly, I will be wrong from time to time, and hopefully, you can prevent me from making significant investment mistakes. Along the way, let's hope that we can make some money in the markets together. So, please reach out to me whenever you want to discuss anything.

For those who know me, I am an investor, not a trader. I have no interest in buying and selling within a year (to avoid the high US short-term capital gains tax, which can be as much as 40% of the gain!). Moreover, some of my best gains in investing history have come from stocks that I held for over five or even ten years, allowing them to compound my wealth at a double-digit rate. While I do invest tactically, my time horizon for these trades is still over one year. Given my investing and career history, I only focus on two markets: the US and China/HK, the top two capital markets in the world. If I can't find anything worth buying there, then I prefer not to buy anything at all.

No more bank run, but…

The main topic I want to discuss in journal #1 is US bank failures and their implications. The world has changed, and there are no longer bank runs where people line up at bank branches to withdraw their money. Today, in my view, we have what I call the "Bank Digital Walk" and the "Bank Digital Sprint."

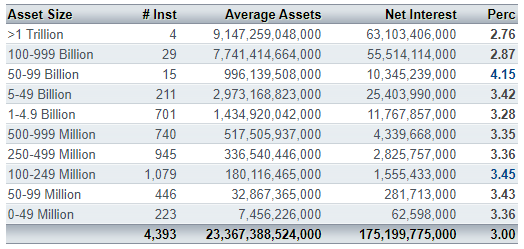

The Bank Digital Walk - depositors are moving their cash out of banks and into money market funds every day, which offer interest rates over 5%, compared to the measly 0.1% offered by banks. Thanks to technological advances, depositors can make this move without even setting foot in a bank branch. You may wonder why banks can't increase their deposit rates to compete with money market funds. Well, their net interest margin on average is only 3% according to bankregdata.com (see table below). Thus, they can't raise their deposit rates to 5% without having a negative net interest margin. This situation is a result of the Fed raising rates too quickly, preventing banks from adjusting their loan book to the new rate environment. The Bank Digital Walk has nothing to do with deposit insurance of $250,000; depositors are simply making a rational decision to earn 5% interest instead of 0.1%. The bank digital walk will continue until the Fed substantially cuts rates, causing rates at money market funds to drop significantly.

US Bank Assets and Net Interest Margin

Source: bankregdata.com

Bank Digital Sprint – As depositors walk out of their banks digitally every day, banks, being mostly publicly traded companies, are required to report their earnings and deposit balances quarterly. With the trend of bank digital walk, it's not difficult to imagine a bank losing 10% to 30% of its deposits in a quarter, which triggers the "bank digital sprint." In 2008, Washington Mutual, the largest bank failure, lost $16.7 billion, or approximately 9% of its deposits, within 9 days. On the other hand, Silicon Valley Bank experienced a staggering loss of $40 billion, or 23% of its deposits, in a single day in March (quite a significant bank digital sprint). The bank digital sprint will occur when a bank announces a significant drop in deposits, leading to panic, massive withdrawals, and bank failures. Again, this trend will continue until the Fed substantially cuts rates. Since the Fed started raising rates in March last year, banks have lost roughly $1 trillion in deposits (see chart below). And in my view, there is more to come...

Implications of Bank Failures

The implications of bank failures are quite straightforward. Banks will become more cautious with their finances and be reluctant to lend. The willingness of banks to provide consumer loans is reflected in the survey conducted by the Fed, shown in the chart below. The current level of unwillingness to lend is reaching levels comparable to those seen during the global financial crisis and the peak of the COVID-19 crisis. Unfortunately, this time around, quantitative easing is unlikely to come to the rescue and alleviate the situation.

Commercial Real Estate

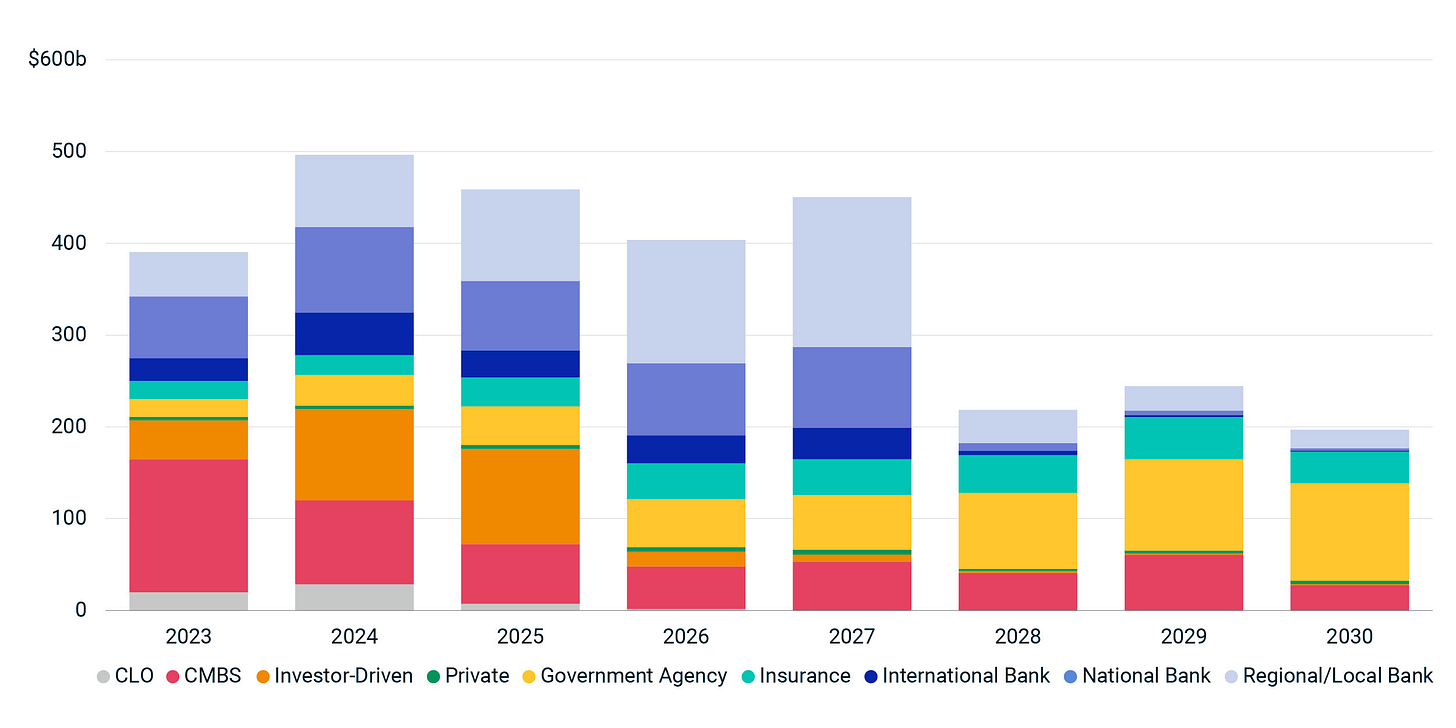

A more significant issue on the horizon, concerning the tightening of credit by banks, is the maturing commercial real estate debt in the coming years. According to the Real Estate Roundtables, the commercial (CRE) and multifamily (MF) commercial real estate market, valued at $20.7 trillion, is financed with $5.5 trillion of debt, with commercial banks providing 50.3% of that financing. Out of the outstanding debt, approximately $1.4 trillion of CRE and MF debt is set to mature within the next 36 months (refer to the chart below).

Maturity Schedule of Commercial Real Estate Loans

Source: https://www.msci.com/www/quick-take/cmbs-dominates-first-wave-of/03740236548

Due to a decade-long zero interest rate policy, these loans were originally financed at low rates and will now need to be refinanced in a world where rates are around 5%, assuming the Federal Reserve doesn't lower rates. However, there is a more pressing concern: the significant decline in the value of commercial office buildings since the onset of the COVID-19 pandemic, as remote work has become the norm. As shown in the charts below, the Bloomberg office REIT index has experienced a decline of over 50% since the beginning of 2022. Additionally, data from Apollo Academy indicates that cellphone activity in most major US downtown areas in 2022 was only a fraction compared to 2019. This paints a grim picture, considering that these numbers reflect a time of full employment in 2022. One can only imagine the impact these figures will have when a recession hits and major layoffs occur. The value of office buildings is likely to further decline, making the refinancing of trillions of dollars in debt even more challenging over the next three years.

Source: https://apolloacademy.com/downtown-has-not-yet-fully-recovered/

Hard landing or harder landing

Hence, while consensus views that a recession is coming soon, I now wonder this coming recession will be a “mild” recession that everyone expects. Credit is like oxygen for the economy; the longer the Fed holding rates at a high level and bank digital walk and sprint continue, US economy will suffocate longer and the more issues the economy will have down the road. Even Fed economists are now predicting a "mild recession," but will they be wrong, as they were in predicting "transitory inflation" in 2021? No one knows for sure, but I would caution against naively assuming that a mild recession is the most likely outcome. Only time will tell. In the meantime, my top investment idea for the next 12 to 18 months is still the 10-year treasury at 3.6% or higher. We are only a couple of weeks away from the debt ceiling deadline, and in my view, US politicians have an unlimited capacity to make dumpiest decisions, which may provide opportunities to buy more treasury bonds.

What make a happy and healthy life?

To conclude my first journal entry on a positive note and to reinforce my desire to strengthen our friendship, I would like to share a link to a TED talk titled "What Makes a Happy and Healthy Life?" This talk discusses Harvard's longest social study, which tracked the lives of 724 men (half from Harvard students and half from the poorest neighborhood in Boston) for over 80 years. The study followed these individuals from their teenage years into old age, with 17 of them still alive as of 2017. The fascinating conclusion drawn from this study is that "a good life is built with good relationships." Here is the link to the TED talk:

Please feel free to reach out to me if there is anything I can do to be of assistance. I value our connection and look forward to further strengthening our friendship.

Enjoyed reading your first Journal this morning, discussed it on the 19th hole over lunch today with two Golf centric investors in Harrison, NY and forwarded this link and Ted Talk video to them. Congratulations on your retirement from corporate life and yes I agree the secret to a successful long professional career and life is the quality of your relationships. You have been a good friend to me since 2003 and I value our friendship.

Good read, thank you. Fully agree that both banks and CRE are facing considerable headwinds! Not sure whether the maturity profile for commercial real estate includes the legacy loans from 1.0 CMBS that are still in special servicing? And on the banks: I've read that in the US Hold-to-Maturity books are largely unhedged as hedge accounting is not available, resulting in significant mark-to-market losses in the treasury portfolios held; yet another reason for depositors to take their money elsewhere ...