Greetings! It’s been a busy and volatile few weeks for Chinese equities since the CCP announced its largest stimulus since the pandemic on September 24. In this journal, I’ll break down the recent events and share my perspective on the latest announcements from the National People’s Congress (NPC) meeting held from November 4 to 8. Finally, no discussion on China would be complete without addressing the outlook for Trump’s trade policy next year. As always, thank you for reading.

China Bazooka

After the CCP’s failed attempt to stimulate consumer confidence in April (see below), the risk of deflation became more apparent (see below), pushing the economy into a "doom loop." Continued challenges in the real estate sector have further depressed confidence and deepened economic fears, suppressing demand and creating a cycle that becomes increasingly difficult to break without substantial intervention.

On September 24, that intervention finally arrived, often referred to as the “China Bazooka.” In addition to traditional monetary tools like an interest rate cut and a reduction in the reserve requirement ratio (RRR) for banks, which I’ll discuss later along with fiscal stimulus measures, there were targeted actions aimed specifically at the housing and stock markets. A summary of the announcements is provided below.

What stood out to investors in the announcement was the CCP's clear intent to directly support the stock and real estate markets. Notably, the RMB 500 billion swap facility, which allows non-bank financial institutions to borrow from the PBOC to invest in the stock market, and the follow-up comments from PBOC Governor Pan Gongsheng were especially well received.

"If the initial 500 billion yuan is successful, a second 500 billion yuan could follow, and potentially even a third 500 billion yuan. I believe this is possible; we remain open to the possibility. The funds obtained under this facility can only be used for investing in the stock market," Pan stated. While such direct and forceful action is common from the Western central bankers, especially during financial crises, seeing this approach from a CCP official is as rare as a unicorn sighting.

Following the announcements, the Chinese equity market enjoyed one of its strongest bull runs in history. However, this rally was short-lived, as additional press conferences by other CCP officials, filled with empty remarks, quickly stoked negative sentiment and deflated the bubble of investor optimism. This may have been part of Xi's strategy to let some air out of the bubble, or it may simply underscore the need for CCP officials to adopt a more refined, Western-style approach to public relations. Either way, these missteps highlight a disconnect between policy intentions and effective communication, underscoring the challenges China faces in managing market expectations.

No Bazooka without Fiscal Stimulus

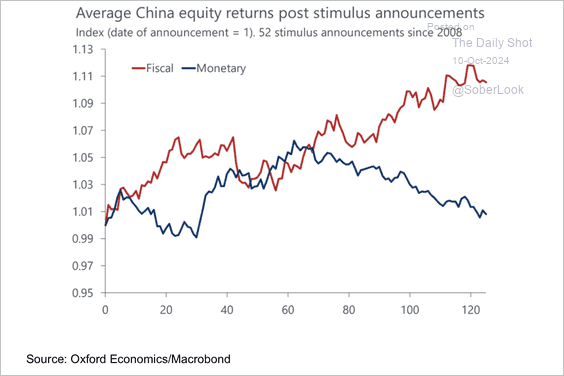

While the announcements on September 24 were certainly welcome, in my view, they don’t quite qualify as a “Bazooka” since no fiscal stimulus was included. As shown in the Oxford Economics analysis below, fiscal stimulus measures have historically been far more effective in sustaining a durable equity rally.

Is Debt Swaps a Fiscal Stimulus?

Fast forward to last Friday, when Beijing concluded its five-day National People’s Congress (NPC) meeting. Investors had been eagerly anticipating announcements of a fiscal stimulus package following the session. Unfortunately, we were largely disappointed again.

While the headline figure of RMB 10 trillion may seem large, it does not represent direct fiscal stimulus. Instead, it is a debt swap program by the central government aimed at bailing out local governments' bad debts. It’s similar to a father negotiating a lower interest rate to cover his son’s accumulated gambling debts, with the father’s guarantee. While this arrangement benefits the son and his creditors, it’s hardly something for the rest of the family to get excited about.

Additionally, this RMB 10 trillion debt swap program is intended to be dispersed over the course of 3-5 years. Therefore, the estimated interest savings of RMB 600 billion for local governments translates to just RMB 120 billion per year—too small to make a meaningful difference in China’s RMB 126 trillion economy.

Lastly, there remains a question of whether the RMB 10 trillion debt swap will be enough to address the “son’s” total gambling debt. According to the IMF, local government hidden debt—primarily held in Local Government Financing Vehicles (LGFVs), the instruments used by local governments to borrow—stands at around RMB 70 trillion (see chart below). Since much of this hidden debt financed infrastructure projects with inadequate returns on capital, it seems likely that the “father” will need to initiate several more rounds of bailouts to fully resolve the issue.

Where is the Direct Consumer Stimulus?

So why is Xi so reluctant to directly stimulate consumer demand and boost consumer confidence? Is he saving his fiscal “bazooka” for next year when Trump reignites the trade war with China? In this case, Xi should brace for the worst in terms of US-China trade relations.

Over the weekend, the Financial Times reported that Trump has asked Robert Lighthizer, who served as US Trade Representative during Trump’s first term, to return to the role. If there’s anyone on earth who does not believe in global trade, it’s Lighthizer.

More importantly, under Trump and Lighthizer, the US and China signed the so-called “Phase One Trade Agreement” in February 2020, in which China committed to purchasing an additional ~$380 billion in goods and services over the following two years. Did China honor this commitment? Unfortunately, the answer is no. According to the Peterson Institute for International Economics, China fell short by 40% (see chart below). As the old saying goes, “Fool me once, shame on you; fool me twice, shame on me.”

Source: https://www.piie.com/research/piie-charts/us-china-phase-one-tracker-chinas-purchases-us-goods

Hence, perhaps Xi is right to save his fiscal firepower. However, there is a problem with the “doom loop”: the longer a patient remains in depression, the harder it becomes to break free. Prolonged depression deepens feelings of hopelessness and reinforces behaviors that make recovery increasingly difficult.

According to Macrobond, using a statistical measure of z-score, China’s current level of low consumer confidence stands at -2.7 (see below) and has remained there for over two years! A z-score of -3 represents an extreme three-standard-deviation event, expected to occur only once in 99 years. In this context, I believe it is far more urgent to pull China’s consumers out of this doom loop now than to stay reactive to U.S. trade policy under Trump.

Lastly, as Xi has increasingly relied on exports to achieve his 5% growth target (see below—net exports were the largest contributor to GDP growth in Q3), he faces significant risks ahead. With Lighthizer likely analyzing the same data and formulating his strategy (or revenge), Xi’s decision to hold back on his fiscal bazooka to stimulate domestic consumption could prove very costly.

As an investor in China, I unloaded a significant portion of my holdings, taking advantage of the China rally in October (no, I didn’t sell at the absolute peak, but at a level higher than today’s). Given Xi’s reluctance to use his fiscal bazooka and with the return of Trump/Lighthizer, I’m considering further reducing my China holdings. I’d welcome your thoughts, as I haven’t yet made a final decision. As always, thanks for reading.